In boardrooms across the globe, executives spend nearly 40 percent of their time making decisions, yet McKinsey research reveals that most believe this time is poorly utilized [1]. This inefficiency comes at a staggering cost—approximately $250 million annually for a typical Fortune 500 company, equivalent to 530,000 days of managers’ time lost to suboptimal decision-making processes [1]. At the heart of this challenge lies a fundamental tension between the classical model of decision-making, which assumes perfect rationality and complete information, and the messy realities of human cognition and organizational constraints.

The classical model, rooted in economic theory and mathematical optimization, has dominated decision science for over a century. However, mounting evidence from behavioral economics, cognitive psychology, and real-world business outcomes suggests that this traditional approach may be fundamentally misaligned with how humans actually make decisions. As organizations increasingly turn to agile frameworks, behavioral insights, and AI-assisted decision-making tools, understanding both the strengths and limitations of classical decision theory becomes crucial for modern leaders seeking to improve their decision-making effectiveness.

Why Decision-Making Models Matter More Than Ever in 2025

The accelerating pace of business change, coupled with increasing complexity and uncertainty, has elevated decision-making from a managerial skill to a core organizational capability. In today’s hyperconnected economy, the consequences of poor decisions cascade rapidly through global supply chains, digital networks, and stakeholder relationships. Organizations that excel at decision-making demonstrate measurably superior performance across key metrics including revenue growth, operational efficiency, and market responsiveness [1].

The evolution from classical to behavioral decision-making models reflects a broader shift in our understanding of human cognition and organizational dynamics. Where classical theory assumed that decision-makers could process unlimited information and consistently optimize outcomes, modern research reveals the profound impact of cognitive biases, emotional factors, and contextual constraints on decision quality. This recognition has sparked the development of alternative frameworks that acknowledge human limitations while providing practical tools for improving decision outcomes.

The emergence of artificial intelligence and machine learning technologies has further complicated the decision-making landscape. While AI systems can process vast amounts of data and identify patterns beyond human capability, they also introduce new challenges around algorithmic bias, interpretability, and human-AI collaboration. Organizations must now navigate the integration of human judgment with algorithmic insights, requiring decision-making frameworks that can accommodate both human intuition and data-driven analysis.

Furthermore, the increasing emphasis on stakeholder capitalism and environmental, social, and governance (ESG) considerations has expanded the scope of decision-making beyond traditional financial metrics. Modern decision-makers must balance multiple, often competing objectives while considering long-term sustainability and social impact. This multi-dimensional complexity challenges the classical model’s assumption of a single, clearly defined utility function and highlights the need for more nuanced approaches to decision-making.

The Foundation of Classical Decision Theory

The classical model of decision-making emerged from the intersection of economic theory, mathematical optimization, and philosophical rationalism. Its intellectual foundations can be traced to the mid-19th century, when economists began developing formal models of human behavior that could support mathematical analysis and prediction. Understanding this historical evolution provides crucial context for appreciating both the model’s enduring influence and its fundamental limitations.

Historical Development and Key Contributors

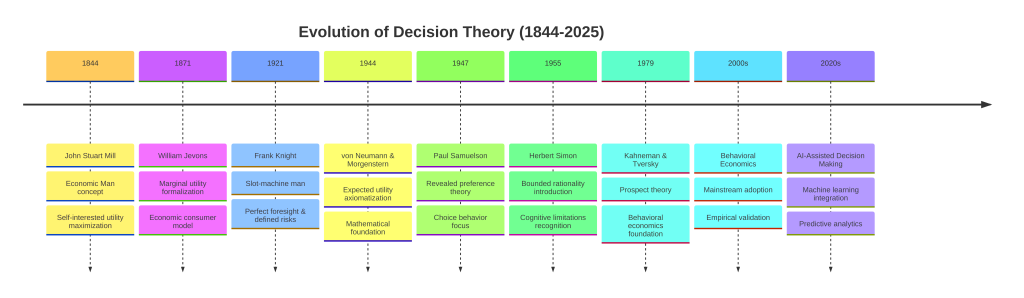

The journey toward classical decision theory began in 1844 when John Stuart Mill introduced the concept of “economic man”—a hypothetical individual who acts as a self-interested agent seeking to maximize personal utility [2]. Mill’s formulation provided the philosophical foundation for treating human decision-making as a rational, calculable process amenable to mathematical modeling. This conceptualization was revolutionary for its time, offering a systematic approach to understanding human behavior that could support both theoretical analysis and practical application.

William Jevons advanced this foundation significantly in 1871 by formalizing the notion of marginal utility, creating a mathematical framework for representing economic consumer behavior [2]. Jevons’ work transformed Mill’s philosophical concept into a practical tool for economic analysis, establishing the mathematical relationships between choices, preferences, and outcomes that would become central to classical decision theory. His marginal utility concept provided the analytical foundation for understanding how rational agents should evaluate trade-offs between different options.

Frank Knight’s contribution in 1921 introduced the “slot-machine man” concept, extending Jevons’ calculator man by incorporating perfect foresight and clearly defined risks [2]. Knight’s model represented a crucial step toward the modern conception of rational decision-making under uncertainty, establishing the theoretical framework for how rational agents should process probabilistic information and make optimal choices in risky environments. This work laid the groundwork for the sophisticated mathematical models that would follow.

The mathematical formalization reached its pinnacle with von Neumann and Morgenstern’s axiomatization in 1944, which provided the rigorous mathematical foundation for expected utility theory [2]. Their work transformed decision theory from a collection of intuitive principles into a formal mathematical system with precise axioms, theorems, and proofs. This axiomatization enabled the development of sophisticated analytical tools and established decision theory as a legitimate field of mathematical inquiry.

Paul Samuelson’s revealed preference formulation in 1947 completed the classical framework by shifting focus from reasoning behavior to choice behavior, emphasizing observable decisions over internal mental processes [2]. This behavioral turn made the theory more empirically tractable while maintaining its mathematical rigor, creating the foundation for modern economic analysis and decision science.

Core Assumptions of Homo Economicus

The classical model rests on three fundamental assumptions about human decision-makers that collectively define the concept of “homo economicus” or “economic man.” These assumptions, while mathematically convenient, represent idealized conditions that rarely exist in real-world decision-making contexts [2].

| Assumption | Classical Theory Requirement | Real-World Reality |

|---|---|---|

| Information Availability | Complete & Perfect | Limited & Imperfect |

| Cognitive Capacity | Unlimited Processing | Bounded Rationality |

| Time Constraints | Unlimited Time | Time Pressure |

| Uncertainty | Eliminated | Inherent & Unavoidable |

| Optimization | Global Maximum | Satisficing Solutions |

| Preferences | Stable & Consistent | Dynamic & Context-Dependent |

The first assumption—complete and perfect information—requires that decision-makers have access to all relevant data about available options, their potential consequences, and the probabilities associated with different outcomes. This assumption enables the mathematical optimization that lies at the heart of classical theory but rarely reflects the information constraints faced by real decision-makers. In practice, information is often incomplete, ambiguous, or costly to obtain, forcing decision-makers to proceed with partial knowledge and uncertain assumptions.

The second assumption—unlimited cognitive capacity—presumes that decision-makers can process any amount of information, perform complex calculations, and maintain perfect logical consistency across all decisions. This assumption underlies the expectation that rational agents will always identify and select optimal solutions. However, extensive research in cognitive psychology has demonstrated that human information processing is subject to significant limitations, including working memory constraints, attention bottlenecks, and systematic biases that affect judgment and choice.

The third assumption—perfect foresight and optimization capability—requires that decision-makers can accurately predict the consequences of their choices and solve complex optimization problems to identify the best possible outcome. This assumption enables the mathematical elegance of expected utility theory but ignores the fundamental uncertainty that characterizes most important decisions. Real-world decision-makers must often rely on heuristics, approximations, and satisficing strategies rather than true optimization.

How the Classical Model Works: The Rational Decision-Making Process

The classical model prescribes a systematic, sequential approach to decision-making that emphasizes logical analysis, mathematical optimization, and utility maximization. This process, while theoretically elegant, requires adherence to strict assumptions about information availability, cognitive capacity, and environmental stability that rarely hold in practice. Understanding the prescribed steps illuminates both the model’s analytical power and its practical limitations.

The Eight-Step Classical Process

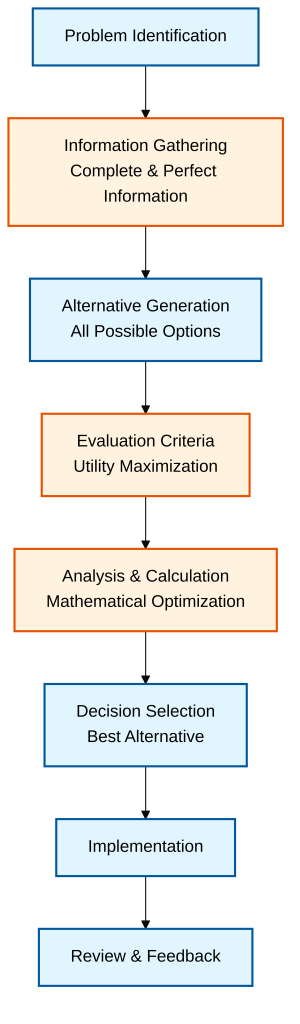

The classical decision-making process follows a linear sequence designed to ensure optimal outcomes through systematic analysis and mathematical optimization. Each step builds upon the previous one, creating a logical progression from problem identification to implementation and review.

The process begins with problem identification, where decision-makers must clearly define the issue requiring resolution. Classical theory assumes that problems present themselves unambiguously and that decision-makers can accurately distinguish between symptoms and root causes. This step requires perfect situational awareness and the ability to frame problems in ways that admit optimal solutions.

The second step, information gathering, demands complete and perfect information about all relevant factors. Classical theory assumes that decision-makers can identify all pertinent information sources, access them without cost or delay, and process the resulting data without error or bias. This requirement for comprehensive information represents one of the model’s most unrealistic assumptions, as real-world decision-makers typically face significant information constraints and must proceed with incomplete data.

The third step involves alternative generation, where decision-makers must identify all possible courses of action. Classical theory requires exhaustive enumeration of options, assuming that decision-makers can conceive of every feasible alternative and accurately assess their viability. This assumption ignores the creative and imaginative aspects of option generation, as well as the practical constraints that limit the number of alternatives that can be meaningfully considered.

The fourth step establishes evaluation criteria based on utility maximization principles. Classical theory assumes that decision-makers can articulate clear, consistent preferences and translate them into mathematical utility functions. This step requires not only perfect self-knowledge but also the ability to quantify subjective values and maintain preference consistency across different contexts and time periods.

The fifth step, analysis and calculation, involves mathematical optimization to identify the alternative that maximizes expected utility. This step assumes that decision-makers possess the computational capacity to perform complex calculations and the analytical skills to correctly apply optimization techniques. The mathematical sophistication required for this step often exceeds the capabilities of real decision-makers, particularly in complex, multi-dimensional choice situations.

The sixth step requires decision selection based on the optimization results. Classical theory assumes that decision-makers will consistently choose the mathematically optimal alternative, regardless of other considerations such as implementation difficulty, political feasibility, or emotional factors. This assumption ignores the many non-rational factors that influence real-world decision-making.

The seventh step involves implementation of the selected alternative. While classical theory focuses primarily on the choice process, it assumes that implementation will proceed smoothly and that the predicted outcomes will materialize as expected. This assumption overlooks the many challenges that can arise during implementation, including resource constraints, organizational resistance, and environmental changes.

The final step encompasses review and feedback, where decision-makers evaluate outcomes and learn from experience. Classical theory assumes that decision-makers can accurately assess results, attribute outcomes to their decisions, and incorporate lessons learned into future decision-making. This assumption ignores the many cognitive biases that affect outcome evaluation and learning from experience.

Expected Utility Theory and Mathematical Foundations

At the mathematical heart of the classical model lies expected utility theory, which provides the formal framework for rational choice under uncertainty. This theory, axiomatized by von Neumann and Morgenstern, establishes the conditions under which preferences can be represented by a mathematical utility function and decisions can be made by maximizing expected utility [2].

Expected utility theory rests on three fundamental axioms that define rational preference relationships. The ordering axiom requires that preferences be both complete and transitive, meaning that decision-makers can compare all pairs of alternatives and maintain logical consistency in their preference rankings [2]. The Archimedean axiom ensures continuity in preference relationships, allowing for meaningful trade-offs between different outcomes. The independence axiom requires that preferences between alternatives remain consistent regardless of the context in which they are presented.

When these axioms are satisfied, preferences can be represented by a mathematical utility function that assigns numerical values to different outcomes. Decision-makers can then calculate the expected utility of each alternative by multiplying the utility of each possible outcome by its probability and summing across all possibilities. The alternative with the highest expected utility represents the rational choice according to classical theory.

This mathematical framework provides powerful analytical tools for decision analysis but requires strong assumptions about human cognition and behavior. The axioms of expected utility theory, while mathematically elegant, often fail to describe how people actually make decisions. Extensive empirical research has documented systematic violations of these axioms, leading to the development of alternative theories that better account for observed decision-making behavior.

Why Classical Models Fall Short in Practice

Despite its mathematical elegance and theoretical appeal, the classical model of decision-making has faced mounting criticism from researchers, practitioners, and organizations seeking to improve their decision-making effectiveness. These criticisms, grounded in empirical evidence from psychology, behavioral economics, and organizational studies, reveal fundamental misalignments between the model’s assumptions and the realities of human cognition and organizational decision-making.

Herbert Simon’s Bounded Rationality Revolution

The most influential critique of classical decision theory came from Herbert Simon, who introduced the concept of “bounded rationality” as an alternative to the perfect rationality assumed by economic models. Simon’s groundbreaking insight was that human decision-makers operate under significant cognitive limitations that make true optimization impossible in most real-world situations [2].

“Broadly stated, the task is to replace the global rationality of economic man with the kind of rational behavior that is compatible with the access to information and the computational capacities that are actually possessed by organisms, including man, in the kinds of environments in which such organisms exist.” — Herbert Simon, 1955 [2]

Simon’s bounded rationality theory fundamentally challenges the classical model’s assumptions about human cognitive capacity. Rather than assuming unlimited information processing ability, bounded rationality recognizes that decision-makers face constraints in attention, memory, and computational capacity that force them to use simplified decision strategies. Instead of optimizing, Simon argued, real decision-makers “satisfice”—they search for alternatives that meet acceptable criteria rather than seeking the theoretically optimal solution.

This shift from optimization to satisficing has profound implications for understanding decision-making effectiveness. While classical theory suggests that any deviation from optimization represents irrationality or error, bounded rationality recognizes that simplified decision strategies may actually be more effective in complex, uncertain environments where the costs of information gathering and analysis exceed the benefits of marginal improvements in decision quality.

Simon’s work also highlighted the importance of procedural rationality—the rationality of the decision-making process itself—as distinct from substantive rationality, which focuses solely on outcomes. This distinction recognizes that good decision-making processes may sometimes lead to suboptimal outcomes due to uncertainty and environmental factors beyond the decision-maker’s control, while poor processes may occasionally produce good outcomes through luck or favorable circumstances.

Empirical Evidence of Classical Model Limitations

Extensive empirical research has documented systematic violations of the classical model’s assumptions and predictions. Studies in cognitive psychology have revealed numerous biases and heuristics that influence human judgment and choice, demonstrating that people consistently deviate from the prescriptions of expected utility theory in predictable ways.

| Characteristic | Classical Model | Bounded Rationality |

|---|---|---|

| Decision Goal | Optimize | Satisfice |

| Information Use | Complete | Available |

| Cognitive Load | Unlimited | Limited |

| Time Horizon | Unlimited | Constrained |

| Solution Quality | Best Possible | Good Enough |

| Real-World Applicability | Low | High |

Research by Daniel Kahneman and Amos Tversky revealed systematic patterns in how people evaluate probabilities and outcomes that violate the axioms of expected utility theory. Their prospect theory demonstrated that people are loss-averse, overweight small probabilities, and frame effects significantly influence choice behavior. These findings challenged the classical assumption that preferences are stable and context-independent.

Organizational research has similarly documented the limitations of classical decision-making in complex institutional settings. Studies of strategic decision-making in corporations reveal that political considerations, resource constraints, and organizational inertia often override purely rational analysis. The classical model’s assumption of a single, unified decision-maker with clear objectives rarely reflects the reality of organizational decision-making, where multiple stakeholders with competing interests must negotiate and compromise.

The Business Cost of Classical Model Limitations

McKinsey’s comprehensive research on organizational decision-making provides compelling evidence of the practical costs associated with classical model limitations. Their studies reveal that executives spend approximately 40 percent of their time making decisions, yet most believe this time is poorly utilized [1]. This inefficiency translates into substantial financial costs, with inefficient decision-making processes costing a typical Fortune 500 company approximately 530,000 days of managers’ time annually, equivalent to about $250 million in wages [1].

The research identifies several specific ways in which classical model assumptions contribute to decision-making inefficiency. The requirement for complete information often leads to “analysis paralysis,” where decision-makers delay action while seeking additional data that may not materially improve decision quality. The emphasis on optimization can result in over-engineering solutions to problems that would be better addressed through simpler, more robust approaches.

Furthermore, the classical model’s focus on individual rationality often ignores the social and political dimensions of organizational decision-making. Decisions that appear optimal from a purely analytical perspective may fail during implementation due to insufficient stakeholder buy-in, cultural resistance, or misalignment with organizational capabilities. The model’s assumption of stable preferences also fails to account for the dynamic nature of organizational priorities and the need for adaptive decision-making in rapidly changing environments.

McKinsey’s research suggests that organizations can significantly improve decision-making effectiveness by adopting more realistic models that account for cognitive limitations, time constraints, and organizational dynamics. Companies that implement agile decision-making frameworks, which emphasize speed, iteration, and stakeholder engagement over exhaustive analysis, demonstrate measurably better performance in terms of both decision quality and implementation success [1].

Decision Fatigue and Cognitive Overload

One of the most significant practical limitations of the classical model is its failure to account for decision fatigue—the deteriorating quality of decisions made after a long session of decision-making. Research in cognitive psychology has demonstrated that the mental resources required for decision-making are finite and become depleted through use, leading to increasingly poor choices as decision-makers become fatigued.

The classical model’s emphasis on comprehensive analysis and optimization exacerbates this problem by requiring extensive cognitive effort for each decision. In contrast to the model’s assumption of unlimited cognitive capacity, real decision-makers must manage their mental resources strategically, reserving intensive analysis for the most important decisions while using simplified heuristics for routine choices.

This resource management challenge is particularly acute in modern organizational environments, where managers face an overwhelming volume of decisions across multiple domains. The classical model’s prescription for thorough analysis of each decision is simply impractical in such contexts, leading to either decision paralysis or the adoption of simplified strategies that deviate significantly from classical prescriptions.

Beyond Classical: Behavioral and Agile Approaches to Decision-Making

The recognition of classical model limitations has sparked the development of alternative approaches that better align with human cognitive capabilities and organizational realities. These modern frameworks, drawing insights from behavioral economics, organizational psychology, and agile methodologies, offer more practical and effective approaches to decision-making in complex, uncertain environments.

Behavioral Decision-Making Models

Behavioral decision-making models represent a fundamental shift from the normative prescriptions of classical theory to descriptive accounts of how people actually make decisions. These models incorporate insights from cognitive psychology about human information processing limitations, systematic biases, and the role of emotions in decision-making. Rather than assuming perfect rationality, behavioral models work with the cognitive tools that people actually possess.

One of the most influential behavioral models is prospect theory, developed by Daniel Kahneman and Amos Tversky, which describes how people evaluate potential losses and gains. Unlike expected utility theory, prospect theory recognizes that people are loss-averse, meaning they feel the pain of losses more acutely than the pleasure of equivalent gains. This insight has profound implications for decision-making in business contexts, where the framing of options as gains or losses can significantly influence choice behavior.

Behavioral models also incorporate the concept of heuristics—mental shortcuts that people use to make decisions quickly and efficiently. While classical theory views heuristics as sources of error and bias, behavioral research has shown that well-chosen heuristics can often produce better outcomes than complex analytical approaches, particularly in uncertain environments where extensive analysis may be counterproductive.

The “fast-and-frugal” heuristics research program, led by Gerd Gigerenzer and colleagues, has demonstrated that simple decision rules can outperform sophisticated statistical models in many real-world contexts. For example, the “recognition heuristic” suggests that when choosing between alternatives, people should select the one they recognize. While this approach violates classical rationality principles, it often produces superior results in domains where recognition correlates with quality or importance.

Agile Decision-Making Frameworks

Agile decision-making frameworks, originally developed in software development but now widely applied across business functions, offer a practical alternative to classical decision-making processes. These frameworks emphasize speed, iteration, and adaptation over comprehensive analysis and optimization. McKinsey research indicates that agile organizations demonstrate superior decision-making effectiveness, with faster response times to market changes and better implementation success rates [1].

The core principles of agile decision-making include iterative development, where decisions are made incrementally with frequent opportunities for course correction; stakeholder collaboration, which ensures that diverse perspectives are incorporated throughout the decision process; and adaptive planning, which recognizes that initial assumptions may prove incorrect and builds in mechanisms for adjustment.

Agile frameworks also emphasize the importance of “failing fast”—making small-scale experiments to test assumptions before committing to large-scale implementations. This approach contrasts sharply with classical decision-making, which assumes that thorough upfront analysis can eliminate the need for experimentation. By embracing controlled failure as a learning mechanism, agile approaches can navigate uncertainty more effectively than classical optimization methods.

The success of agile decision-making frameworks reflects their alignment with human cognitive capabilities and organizational dynamics. Rather than fighting against cognitive limitations, these frameworks work with them by breaking complex decisions into manageable components, providing frequent feedback loops, and maintaining flexibility in the face of changing circumstances.

AI-Assisted Decision-Making Systems

The emergence of artificial intelligence and machine learning technologies has created new possibilities for enhancing human decision-making while addressing some limitations of classical models. AI-assisted decision-making systems can process vast amounts of data, identify complex patterns, and generate insights that would be impossible for human decision-makers to develop independently.

However, effective AI-assisted decision-making requires careful integration of human judgment with algorithmic analysis. While AI systems excel at pattern recognition and data processing, they often struggle with contextual understanding, ethical considerations, and the kind of creative problem-solving that characterizes many important business decisions. The most effective approaches combine AI’s analytical capabilities with human insight, intuition, and values-based reasoning.

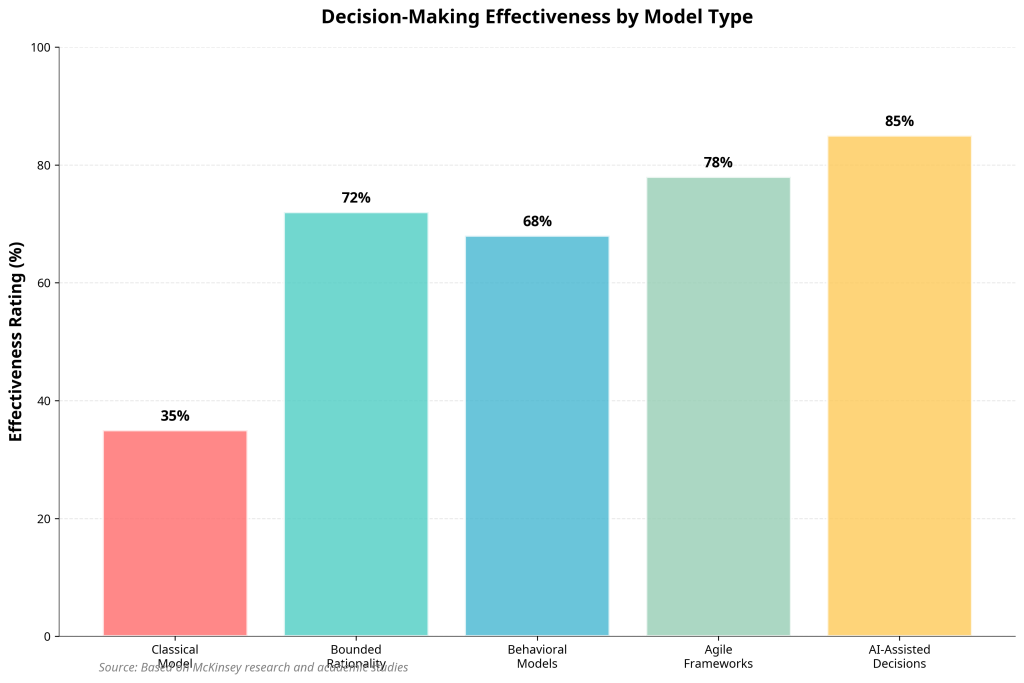

Research suggests that AI-assisted decision-making can achieve effectiveness ratings of up to 85 percent, significantly higher than purely classical or behavioral approaches [3]. However, this superior performance depends on appropriate human-AI collaboration, where humans provide context, values, and strategic direction while AI systems contribute data analysis, pattern recognition, and scenario modeling.

The integration of AI into decision-making processes also raises important questions about transparency, accountability, and bias. Unlike classical decision models, which provide clear logical pathways from assumptions to conclusions, many AI systems operate as “black boxes” that produce recommendations without easily interpretable explanations. Organizations must balance the analytical power of AI with the need for decision transparency and human oversight.

Case Study: Fortune 500 Transformation

A leading Fortune 500 technology company provides a compelling example of the practical benefits of moving beyond classical decision-making models. Facing increasing market volatility and competitive pressure, the company implemented a hybrid decision-making framework that combined behavioral insights, agile methodologies, and AI-assisted analysis.

The transformation began with an assessment of existing decision-making processes, which revealed classic symptoms of classical model limitations: lengthy analysis cycles, decision paralysis on complex issues, and poor implementation success rates. The company’s traditional approach emphasized comprehensive market research, detailed financial modeling, and extensive stakeholder review processes that often took months to complete.

The new framework introduced several key changes. First, the company categorized decisions based on their strategic importance and uncertainty levels, applying different processes to different types of decisions. Routine operational decisions were delegated to lower organizational levels with clear guidelines and automated support systems. Strategic decisions retained more extensive analysis but incorporated behavioral insights about cognitive biases and stakeholder dynamics.

Second, the company implemented agile decision-making processes for product development and market entry decisions. These processes emphasized rapid prototyping, customer feedback loops, and iterative refinement rather than comprehensive upfront planning. Cross-functional teams were empowered to make decisions quickly within defined parameters, with regular review and adjustment cycles.

Third, the company invested in AI-assisted decision support systems that could process market data, customer feedback, and competitive intelligence to provide real-time insights for strategic decisions. These systems were designed to augment rather than replace human judgment, providing analytical support while preserving human oversight and values-based reasoning.

The results of this transformation were substantial. Decision cycle times decreased by an average of 40 percent, while implementation success rates improved by 25 percent. Employee satisfaction with decision-making processes increased significantly, and the company demonstrated improved responsiveness to market changes and competitive threats.

However, the transformation also revealed important limitations and challenges. The transition required significant investment in training and change management, as employees needed to develop new skills and adapt to different ways of working. Some decisions still benefited from classical analytical approaches, particularly those involving well-defined problems with stable parameters. The company learned that effective decision-making requires a portfolio of approaches rather than a single universal method.

Implementing Better Decision-Making Frameworks: A Practical Action Plan

Organizations seeking to improve their decision-making effectiveness must move beyond the theoretical limitations of classical models toward practical frameworks that account for human cognitive capabilities, organizational dynamics, and environmental uncertainty. This transition requires systematic assessment, strategic planning, and careful implementation of new approaches that balance analytical rigor with practical feasibility.

Assessment of Current Decision Processes

The first step in improving organizational decision-making involves conducting a comprehensive assessment of existing processes to identify strengths, weaknesses, and opportunities for improvement. This assessment should examine decision-making across multiple organizational levels and functional areas, recognizing that different types of decisions may require different approaches.

Organizations should begin by mapping their current decision-making processes, documenting the steps involved, the stakeholders engaged, and the time required for different types of decisions. This mapping exercise often reveals significant variation in how decisions are made across the organization, with some areas adhering closely to classical analytical approaches while others have developed more informal, intuitive methods.

The assessment should also examine decision outcomes, measuring both the quality of decisions and the effectiveness of implementation. Key metrics include decision cycle time, implementation success rates, stakeholder satisfaction, and long-term outcome achievement. Organizations should pay particular attention to decisions that have failed or underperformed, analyzing the root causes and identifying patterns that suggest systematic problems with current approaches.

Additionally, the assessment should evaluate the cognitive and emotional factors that influence decision-making within the organization. This includes examining the prevalence of cognitive biases, the impact of organizational culture on decision-making, and the extent to which political and social factors override analytical considerations. Understanding these human factors is crucial for designing interventions that will be effective in practice.

Hybrid Approach Recommendations

Based on current research and best practices, organizations should implement hybrid decision-making frameworks that combine the analytical strengths of classical approaches with the practical insights of behavioral and agile methodologies. This hybrid approach recognizes that different types of decisions require different processes and that no single model is optimal for all situations.

For routine operational decisions with well-defined parameters and stable environments, organizations can benefit from streamlined analytical processes that incorporate classical optimization techniques. These decisions should be supported by clear guidelines, automated decision support systems, and delegation to appropriate organizational levels to reduce cognitive load on senior decision-makers.

For strategic decisions involving high uncertainty and significant stakeholder impact, organizations should adopt agile decision-making processes that emphasize iteration, experimentation, and stakeholder engagement. These processes should incorporate behavioral insights about cognitive biases and group dynamics while maintaining sufficient analytical rigor to support sound reasoning.

For complex decisions requiring extensive data analysis, organizations should implement AI-assisted decision support systems that can process large amounts of information while preserving human oversight and values-based reasoning. These systems should be designed to augment rather than replace human judgment, providing analytical insights while maintaining transparency and accountability.

The hybrid approach should also include explicit mechanisms for learning and adaptation, recognizing that decision-making frameworks must evolve as organizations gain experience and face new challenges. Regular review and refinement of decision processes ensures that they remain effective and aligned with organizational needs.

Training and Development Strategies

Implementing improved decision-making frameworks requires significant investment in training and development to help employees develop new skills and adapt to different ways of working. This training should address both the technical aspects of new decision-making tools and the behavioral changes required for effective implementation.

Training programs should begin with education about cognitive biases and their impact on decision-making. Employees need to understand how biases such as confirmation bias, anchoring, and availability heuristic can distort judgment and learn techniques for mitigating their effects. This education should be practical and experiential, using real organizational examples and case studies to illustrate key concepts.

Organizations should also provide training in agile decision-making methodologies, including techniques for rapid prototyping, stakeholder engagement, and iterative refinement. This training should emphasize the mindset shifts required for agile approaches, including comfort with uncertainty, willingness to experiment, and acceptance of controlled failure as a learning mechanism.

For decisions involving AI-assisted systems, training should focus on effective human-AI collaboration, including understanding the capabilities and limitations of AI systems, interpreting algorithmic outputs, and maintaining appropriate human oversight. Employees need to develop skills in working with AI as a decision support tool rather than viewing it as a replacement for human judgment.

Training programs should also address the social and political dimensions of organizational decision-making, helping employees navigate stakeholder dynamics, build consensus, and manage implementation challenges. These “soft skills” are often as important as analytical capabilities for achieving successful decision outcomes.

Measurement and Improvement Metrics

Effective implementation of improved decision-making frameworks requires robust measurement systems that can track progress and identify areas for further improvement. These measurement systems should capture both process metrics (how decisions are made) and outcome metrics (the results of decisions).

Key process metrics include decision cycle time, stakeholder engagement levels, use of analytical tools and frameworks, and adherence to established decision-making procedures. These metrics help organizations understand whether new frameworks are being implemented as intended and identify areas where additional support or training may be needed.

Outcome metrics should include decision quality assessments, implementation success rates, stakeholder satisfaction, and long-term performance against objectives. Organizations should also track leading indicators such as employee confidence in decision-making processes and willingness to take appropriate risks.

The measurement system should include regular feedback loops that allow for continuous improvement of decision-making processes. This includes post-decision reviews that examine what worked well and what could be improved, as well as periodic assessments of overall decision-making effectiveness across the organization.

Organizations should also benchmark their decision-making performance against industry peers and best-practice organizations to identify opportunities for further improvement. This external perspective can reveal blind spots and suggest new approaches that may not be apparent from internal analysis alone.

The Future of Decision-Making Models

The evolution of decision-making models continues to accelerate as new technologies, changing business environments, and deeper understanding of human cognition create both opportunities and challenges for organizations seeking to improve their decision-making effectiveness. The future landscape will likely be characterized by increased integration of artificial intelligence, greater emphasis on real-time adaptation, and more sophisticated approaches to human-AI collaboration.

AI and Machine Learning Integration

Artificial intelligence and machine learning technologies will play an increasingly central role in organizational decision-making, but their integration will require careful attention to human factors and ethical considerations. Future AI systems will likely become more sophisticated in their ability to process unstructured data, recognize complex patterns, and generate actionable insights. However, the most effective applications will continue to emphasize human-AI collaboration rather than full automation of decision-making processes.

The development of explainable AI technologies will address current concerns about algorithmic transparency and accountability. These systems will provide clear explanations for their recommendations, enabling human decision-makers to understand and validate AI-generated insights. This transparency will be crucial for maintaining trust and ensuring appropriate human oversight of AI-assisted decisions.

Predictive decision analytics will become more sophisticated, enabling organizations to anticipate decision points and prepare alternative scenarios before they become urgent. These systems will help organizations move from reactive to proactive decision-making, reducing time pressure and improving decision quality through better preparation and analysis.

Emerging Trends and Risks

Several emerging trends will shape the future of organizational decision-making. The increasing pace of business change will continue to favor agile, adaptive approaches over classical analytical methods. Organizations will need to develop capabilities for rapid decision-making while maintaining appropriate quality controls and risk management.

The growing emphasis on stakeholder capitalism and ESG considerations will require decision-making frameworks that can balance multiple, often competing objectives. Future models will need to incorporate social and environmental factors alongside traditional financial metrics, requiring more sophisticated approaches to multi-criteria decision-making.

However, these developments also create new risks that organizations must navigate carefully. Over-reliance on AI systems could lead to deskilling of human decision-makers and reduced organizational resilience when AI systems fail or encounter situations outside their training parameters. Organizations must maintain human decision-making capabilities even as they increasingly rely on AI assistance.

The proliferation of data and analytical tools could also lead to new forms of analysis paralysis, where organizations become overwhelmed by the volume of available information and struggle to focus on the most important factors. Future decision-making frameworks will need to include explicit mechanisms for managing information overload and maintaining focus on key priorities.

Key Takeaways

- Classical decision-making models cost organizations significantly: McKinsey research shows that inefficient decision-making processes cost Fortune 500 companies approximately $250 million annually, equivalent to 530,000 days of managers’ time, highlighting the urgent need for more effective approaches.

- Bounded rationality offers a more realistic framework: Herbert Simon’s bounded rationality theory, which recognizes cognitive limitations and promotes “satisficing” over optimization, provides a more practical foundation for real-world decision-making than classical models that assume perfect information and unlimited cognitive capacity.

- Hybrid approaches deliver superior results: Organizations that combine analytical rigor with behavioral insights and agile methodologies achieve effectiveness ratings of up to 78 percent for agile frameworks and 85 percent for AI-assisted systems, compared to only 35 percent for purely classical approaches.

- Implementation requires systematic change management: Successfully transitioning from classical to modern decision-making frameworks requires comprehensive assessment of current processes, targeted training programs, and robust measurement systems to ensure sustainable improvement in decision-making effectiveness.

References

[1] McKinsey & Company. (2023). What is decision making? McKinsey Featured Insights.

[2] Stanford Encyclopedia of Philosophy. (2024). Bounded Rationality. Stanford University.

[3] Stanford Encyclopedia of Philosophy. (2020). Decision Theory. Stanford University.