Market disruptions have become the defining characteristic of modern business, with 90% of companies failing within a year if they cannot resume operations within five days of a major disruption [1]. As we advance through 2025, the frequency and intensity of these disruptions continue to accelerate, driven by technological innovation, economic volatility, and unprecedented global interconnectedness. Recent data from the White House Council of Economic Advisers reveals that supply chain disruptions alone contributed to 25% of total GDP decline during the pandemic, while shipping costs surged to 1000% of pre-pandemic levels [2]. Yet amid this turbulence, a critical pattern emerges: organizations that proactively build resilience not only survive disruptions but often emerge stronger, with small companies showing 2.7 times higher success rates in digital transformation initiatives compared to their larger counterparts [3].

Why Market Disruption Resilience is Critical for 2025 and Beyond

The business landscape of 2025 presents unprecedented challenges that demand a fundamental shift in how organizations approach resilience and adaptation. Unlike previous decades, where disruptions were often isolated events affecting specific industries or regions, today’s disruptions cascade across interconnected global systems with devastating speed and scope. The COVID-19 pandemic served as a stark reminder of this reality, demonstrating how a health crisis could instantly transform into a supply chain catastrophe, economic recession, and digital acceleration event simultaneously.

Federal Reserve research indicates that deeply intertwined supply chains can turn micro disruptions into macro-level effects, a phenomenon that has become increasingly pronounced as global connectivity has expanded [4]. The 2011 Great East Japan Earthquake provides a compelling case study: this single event reduced Japan’s real GDP growth by 0.47 percentage points and caused U.S. manufacturing output to decline by one percentage point due to supply chain linkages [5]. These interconnected vulnerabilities have only intensified in the intervening years.

The acceleration of technological change compounds these challenges. Harvard Business School research reveals that 95% of new products fail to meet market expectations, with nearly 30,000 new products introduced annually [6]. This staggering failure rate reflects not just poor product development but the increasing difficulty of predicting market needs in rapidly evolving environments. Organizations that once enjoyed decades of stable competitive advantage now face the possibility of obsolescence within months.

Climate change introduces another layer of complexity, with weather-related disruptions expected to become more frequent and severe over the next decade [7]. The Economic Development Administration emphasizes that economic resilience must now account for both traditional business risks and emerging environmental challenges that can simultaneously affect multiple aspects of operations [8].

Perhaps most critically, the data reveals a stark divide between organizations that proactively build resilience and those that react to disruptions. Small Business Administration research shows that businesses with comprehensive resilience plans are significantly more likely to survive and thrive during disruptions, while those without such plans face a 90% failure rate if operations are interrupted for more than five days [9]. This statistic alone underscores why resilience planning has evolved from a nice-to-have capability to an existential necessity.

Understanding the Anatomy of Modern Market Disruptions

Market disruptions in the contemporary business environment exhibit distinct characteristics that differentiate them from historical patterns of change. Academic research from ScienceDirect defines market disruptions as sudden and dramatic shifts that fundamentally alter competitive paradigms, forcing companies to reconsider their business models, operational approaches, and strategic positioning [10]. However, this definition, while accurate, fails to capture the multifaceted nature of modern disruptions that often originate from multiple sources simultaneously.

The primary drivers of market disruption fall into three interconnected categories, each with distinct characteristics and impact patterns. Technological innovations represent the most visible and frequently discussed disruption source, with electric vehicles serving as a prime example. Early successes of hybrid and electric vehicle models, combined with increasing environmental awareness, have fundamentally altered the automotive industry’s trajectory [11]. However, the disruption extends beyond product innovation to encompass manufacturing processes, supply chain requirements, charging infrastructure, and even urban planning considerations.

Economic fundamentals constitute the second major disruption category, with recessions and financial crises creating rapid shifts in consumer demand patterns. The Federal Reserve’s analysis of trade disruptions reveals that economic shocks can propagate through supply chains with remarkable speed, creating inflationary pressures that persist long after the initial disruption subsides [12]. The Global Supply Chain Pressure Index, produced by the Federal Reserve Bank of New York, reached its highest-ever recorded value during the pandemic, demonstrating how economic disruptions can cascade across multiple sectors simultaneously [13].

Regulatory changes represent the third primary disruption source, often creating immediate and non-negotiable shifts in operating requirements. New York City’s ordinance targeting Airbnb operations exemplifies how regulatory disruptions can instantly transform business models and market dynamics [14]. Unlike technological or economic disruptions that may evolve gradually, regulatory changes often impose immediate compliance requirements that can fundamentally alter industry structures overnight.

The interconnected nature of these disruption sources creates what researchers term “disruption cascades,” where initial shocks in one area trigger secondary and tertiary effects across seemingly unrelated domains. The COVID-19 pandemic exemplifies this phenomenon: what began as a health crisis rapidly evolved into supply chain disruptions, labor shortages, regulatory changes, technological acceleration, and fundamental shifts in consumer behavior. Organizations that understood these interconnections were better positioned to anticipate and respond to the full scope of changes.

Digital technology disruptions have proven particularly transformative, revolutionizing industries from retail to media consumption. E-commerce platforms have fundamentally challenged brick-and-mortar retail models, while streaming services have redefined content consumption patterns [15]. The failure of companies like Blockbuster to adapt to digital disruption serves as a cautionary tale, while the success of companies like Tesla demonstrates the potential rewards for organizations that fully embrace disruptive technologies [16].

Research from the IEEE Transactions on Engineering Management reveals that successful navigation of technological disruptions requires understanding the difference between sustaining and disruptive innovations [17]. Sustaining innovations improve existing products for established customers, while disruptive innovations initially serve new or low-end market segments before eventually displacing established solutions. Organizations that mistake disruptive innovations for sustaining ones often allocate resources inappropriately, leading to strategic misalignment and competitive vulnerability.

| Disruption Type | Typical Timeline | Primary Impact | Response Complexity |

|---|---|---|---|

| Technological Innovation | 2-10 years | Product/Service obsolescence | High – requires R&D investment |

| Economic Shifts | 6 months – 3 years | Demand pattern changes | Medium – operational adjustments |

| Regulatory Changes | Immediate – 2 years | Compliance requirements | Variable – depends on scope |

| Natural Disasters | Immediate | Operational disruption | High – requires comprehensive planning |

The velocity of modern disruptions has accelerated significantly compared to historical patterns. While previous generations of business leaders could often anticipate and gradually adapt to changing conditions over years or decades, contemporary disruptions frequently unfold over months or even weeks. This acceleration demands new approaches to strategic planning, risk assessment, and organizational agility that traditional management frameworks struggle to accommodate.

The Economic Reality: Quantifying Disruption Impact

The economic consequences of market disruptions extend far beyond immediate operational challenges, creating ripple effects that can persist for years and fundamentally alter industry structures. Comprehensive analysis of disruption impacts reveals patterns that challenge conventional assumptions about business resilience and recovery timelines. Understanding these economic realities is essential for developing effective response strategies and building organizational resilience.

Business survival statistics paint a sobering picture of organizational vulnerability in disrupted markets. Recent data indicates that 20.8% to 23.2% of businesses fail within their first year, with failure rates climbing to 48-50% within five years and reaching 65.3% within ten years [18]. These baseline failure rates increase dramatically during periods of significant market disruption, when external pressures compound normal operational challenges.

The relationship between disruption duration and business survival reveals critical thresholds that organizations must understand. Research consistently shows that 90% of businesses fail within a year if they cannot resume operations within five days of a major disruption [19]. This statistic underscores the importance of business continuity planning and rapid response capabilities. However, the data also reveals that organizations with robust resilience frameworks can significantly improve their survival odds, with recovery times advancing by an average of six days when economic resilience measures are implemented [20].

| Time Period | Survival Rate | Failure Rate | Key Challenges |

|---|---|---|---|

| First Year | 76.8% – 79.2% | 20.8% – 23.2% | Cash flow, market validation |

| Five Years | 50% – 52% | 48% – 50% | Competition, scaling challenges |

| Ten Years | 34.7% | 65.3% | Market disruption, adaptation |

| Twenty Years | 20% | 80% | Technological obsolescence |

Supply chain disruptions represent one of the most economically significant categories of market disruption, with effects that cascade through entire economic systems. The White House Council of Economic Advisers’ analysis of pandemic-related disruptions reveals that supply chain bottlenecks were responsible for a significant share of U.S. inflation from 2021 to 2022 [21]. At the peak of disruption, spot shipping prices for containers from China to U.S. West Coast ports reached more than 1000% of 2019 levels, demonstrating how supply chain vulnerabilities can create extreme cost pressures [22].

The macroeconomic implications of supply chain disruptions extend beyond immediate cost increases. Research examining 64 countries found that approximately 25% of total real GDP decline during the pandemic resulted from national lockdowns and their effects on labor availability transmitted through global supply chains [23]. This finding highlights how localized disruptions can create global economic consequences through interconnected supply networks.

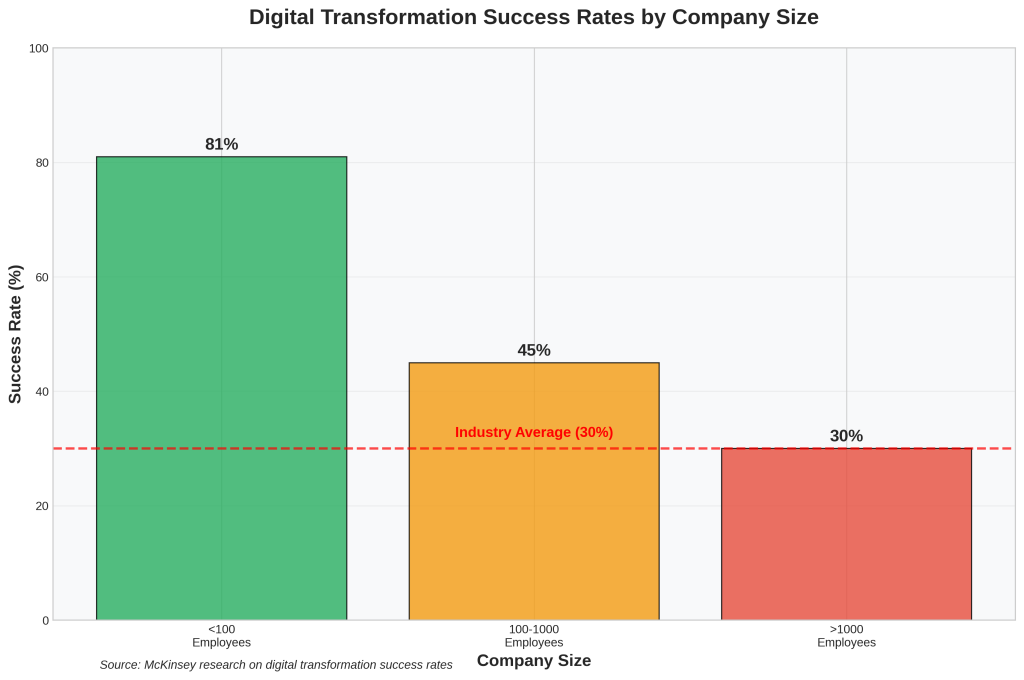

Digital transformation initiatives, while often positioned as solutions to disruption challenges, carry their own economic risks and rewards. McKinsey research reveals that only 30% of digital transformations fully succeed in meeting their stated objectives [24]. However, organizations that do achieve successful digital transformation often realize significant competitive advantages, particularly smaller companies that demonstrate 2.7 times higher success rates compared to larger enterprises [25].

The economic impact of failed digital transformation attempts can be substantial, with organizations investing significant resources in initiatives that fail to deliver expected returns. Conversely, successful transformations can create sustainable competitive advantages and improved resilience to future disruptions. The key differentiator appears to be the quality of business case development, with expert-developed cases achieving 47% success rates compared to much lower rates for internally developed initiatives [26].

Innovation failure rates provide additional context for understanding disruption economics. Harvard Business School research indicates that 95% of new products fail to meet market expectations, representing substantial sunk costs for organizations across industries [27]. This high failure rate reflects the difficulty of predicting market needs in rapidly changing environments and underscores the importance of rapid experimentation and iterative development approaches.

| Disruption Event | Economic Impact | Recovery Time | Key Lessons |

|---|---|---|---|

| COVID-19 Pandemic | 25% of GDP decline via supply chains | Ongoing | Supply chain diversification critical |

| Japan Earthquake 2011 | 0.47% GDP growth reduction | 1+ years | Global interconnectedness vulnerability |

| Shipping Cost Surge | 1000% price increase | 2+ years | Just-in-time model fragility |

| General Disaster | 90% business failure if >5 days down | 5 days critical | Business continuity planning essential |

The economic data reveals clear patterns that organizations can use to inform their resilience strategies. First, the relationship between disruption duration and survival probability is non-linear, with critical thresholds at five days and longer periods. Second, smaller organizations often demonstrate greater agility and higher success rates in adaptation efforts. Third, proactive resilience investments can significantly improve recovery times and survival odds. Finally, the interconnected nature of modern economic systems means that disruptions in one area can create cascading effects across multiple domains, requiring comprehensive rather than narrow response strategies.

Building Organizational Resilience: A Data-Driven Framework

Organizational resilience represents more than the ability to survive disruptions; it encompasses the capacity to adapt, learn, and emerge stronger from challenging circumstances. Academic research defines resilience as the ability of supply chains and business systems to recover quickly from unexpected events through better data utilization, redundancy investments, improved substitution capabilities, and enhanced communication across organizational networks [28]. However, building effective resilience requires understanding the specific components that contribute to organizational durability and the evidence-based practices that enhance adaptive capacity.

The foundation of organizational resilience rests on comprehensive risk assessment and business continuity planning. The Small Business Administration’s 2024 Business Resilience Guide emphasizes that effective resilience planning must address six critical areas: risk identification, impact assessment, response planning, resource allocation, communication protocols, and recovery procedures [29]. Organizations that implement comprehensive planning across all six areas demonstrate significantly higher survival rates during disruptions compared to those with partial or ad hoc approaches.

Financial resilience forms a critical component of overall organizational durability, with cash flow management and reserve planning serving as primary determinants of survival during extended disruptions. Research indicates that organizations with financial reserves sufficient to cover 90 days of operations without revenue have substantially higher survival rates during major disruptions [30]. However, the optimal reserve level varies by industry, with service-based businesses typically requiring smaller reserves than manufacturing or inventory-intensive operations.

Supply chain diversification represents another essential element of resilience frameworks, particularly given the interconnected nature of modern business operations. The White House Council of Economic Advisers’ research demonstrates that supply chains relying on broader diversity of input suppliers are more easily able to switch to alternative providers during concentrated shocks [31]. This diversification principle extends beyond supplier relationships to encompass geographic distribution, transportation modes, and inventory management strategies.

The concept of “just-in-time” supply chain management, while efficient under stable conditions, has proven particularly vulnerable to disruptions. Originally designed for production and suppliers in relative proximity, just-in-time approaches assume relatively stable environments with minimal shocks [32]. The reality of global value chain networks spanning long distances has exposed the fragility of these systems, leading many organizations to reconsider their approach to inventory management and supplier relationships.

Technological resilience has emerged as a critical capability in an increasingly digital business environment. Organizations must balance the efficiency gains from technological integration with the vulnerabilities created by system dependencies. Research from IEEE Transactions reveals that successful technological resilience requires redundant systems, regular backup procedures, cybersecurity protocols, and staff training programs that enable rapid response to technical disruptions [33].

Human capital resilience often receives insufficient attention in traditional business continuity planning, despite its critical importance during disruptions. Engaged employees serve as key assets during challenging periods, with research indicating that organizations with high employee engagement levels demonstrate superior performance during disruptions [34]. Professional development programs, collaborative work environments, and comprehensive well-being support systems contribute to workforce resilience and organizational adaptability.

The development of adaptive leadership capabilities represents a crucial but often overlooked component of resilience frameworks. Visionary leadership becomes particularly important during disruptions, when clear communication and decisive decision-making can determine organizational survival [35]. Leaders must balance the need for rapid response with the importance of stakeholder engagement and long-term strategic thinking.

Cultural resilience encompasses the organizational values, practices, and mindsets that enable effective adaptation to changing circumstances. Organizations that cultivate cultures of innovation, continuous learning, and calculated risk-taking demonstrate superior performance during disruptions compared to those with rigid, hierarchical cultures [36]. This cultural dimension of resilience often proves more challenging to develop than technical or financial capabilities, but provides sustainable competitive advantages during extended periods of uncertainty.

| Resilience Component | Implementation Timeline | Resource Requirements | Impact on Survival |

|---|---|---|---|

| Financial Reserves | 6-12 months | High capital allocation | Critical for short-term survival |

| Supply Chain Diversification | 12-24 months | Medium operational changes | Essential for operational continuity |

| Technology Redundancy | 3-9 months | Medium infrastructure investment | Important for digital operations |

| Workforce Development | Ongoing | Medium training investment | Crucial for adaptation capability |

| Cultural Transformation | 2-5 years | High leadership commitment | Fundamental for long-term success |

The integration of these resilience components requires careful coordination and strategic planning. Organizations cannot simply implement individual elements in isolation; effective resilience emerges from the synergistic interaction of financial, operational, technological, human, and cultural capabilities. Research indicates that organizations applying best practices across all resilience dimensions maximize their chances of not only surviving disruptions but exceeding performance expectations during recovery periods [37].

Measurement and monitoring systems play essential roles in the resilience framework’s effectiveness. Organizations must establish key performance indicators that provide early warning signals of potential disruptions and track the effectiveness of resilience investments over time. The Federal Reserve Bank of New York’s Global Supply Chain Pressure Index provides an example of how systematic monitoring can help organizations anticipate and prepare for disruptions before they reach critical levels [38].

The economic benefits of resilience investments often extend beyond disruption survival to include improved operational efficiency, enhanced customer relationships, and stronger competitive positioning. Organizations that view resilience as a strategic capability rather than a cost center typically achieve superior long-term performance and demonstrate greater ability to capitalize on opportunities that emerge during periods of market turbulence.

Digital Transformation as a Resilience Strategy

Digital transformation has evolved from a competitive advantage initiative to an essential resilience strategy, with organizations increasingly recognizing that digital capabilities provide critical buffers against various forms of market disruption. However, the relationship between digital transformation and resilience is complex, with success rates varying dramatically based on implementation approach, organizational characteristics, and strategic alignment. Understanding the evidence-based factors that contribute to successful digital transformation is essential for organizations seeking to enhance their resilience through technological advancement.

The statistical reality of digital transformation initiatives reveals both the potential and the challenges associated with this approach to resilience building. McKinsey research consistently shows that only 30% of digital transformations fully succeed in meeting their stated objectives [39]. This relatively low success rate reflects the complexity of digital transformation initiatives and the multiple factors that must align for successful implementation. However, organizations that do achieve successful digital transformation often realize substantial benefits in terms of operational efficiency, customer engagement, and market responsiveness.

Company size emerges as a significant predictor of digital transformation success, with smaller organizations demonstrating markedly superior performance compared to their larger counterparts. Research indicates that organizations with fewer than 100 employees are 2.7 times more likely to report successful digital transformation outcomes [40]. This size advantage appears to stem from greater organizational agility, faster decision-making processes, and reduced complexity in change management initiatives.

The quality of business case development represents another critical success factor in digital transformation initiatives. Organizations with expert-developed business cases achieve 47% success rates, significantly higher than those relying on internally developed cases without external expertise [41]. This finding suggests that successful digital transformation requires specialized knowledge and experience that many organizations lack internally, highlighting the value of strategic partnerships and external consulting relationships.

| Success Factor | Success Rate | Impact Level | Implementation Difficulty |

|---|---|---|---|

| Expert-developed business case | 47% | High | Medium |

| Small organization size (<100 employees) | 2.7x higher | Very High | Low |

| All five best practices applied | Maximized | Very High | High |

| Average transformation | 30% | Baseline | Variable |

The application of comprehensive best practices across all dimensions of digital transformation maximizes the probability of success and enhances resilience benefits. Research identifies five critical practice areas that organizations must address: strategic alignment, leadership commitment, workforce development, technology integration, and performance measurement [42]. Organizations that excel in all five areas demonstrate superior transformation outcomes and greater resilience to subsequent disruptions.

Strategic alignment requires ensuring that digital transformation initiatives directly support broader organizational objectives and resilience goals. Many transformation failures result from technology-driven approaches that lack clear connections to business strategy or customer value creation. Successful organizations begin with strategic objectives and work backward to identify the digital capabilities required to achieve those goals, rather than starting with technology solutions and seeking applications.

Leadership commitment extends beyond financial investment to encompass active engagement, clear communication, and sustained support throughout the transformation process. Digital transformation initiatives often encounter resistance, setbacks, and unexpected challenges that require strong leadership to navigate successfully. Organizations with committed leadership demonstrate higher success rates and greater ability to maintain momentum during difficult implementation phases.

Workforce development represents a critical but often underestimated component of successful digital transformation. Technology implementation alone rarely delivers expected benefits without corresponding investments in employee training, skill development, and change management support. Organizations that prioritize workforce development during digital transformation initiatives achieve higher adoption rates, improved performance outcomes, and greater employee satisfaction with transformation results.

Technology integration challenges frequently derail digital transformation initiatives, particularly in organizations with legacy systems and complex operational requirements. Successful integration requires careful planning, phased implementation approaches, and robust testing procedures that minimize disruption to ongoing operations. Organizations that underestimate integration complexity often experience cost overruns, timeline delays, and performance issues that undermine transformation objectives.

Performance measurement systems enable organizations to track transformation progress, identify areas requiring adjustment, and demonstrate value creation to stakeholders. Effective measurement goes beyond technical metrics to encompass business outcomes, customer satisfaction, and employee engagement indicators. Organizations with comprehensive measurement systems can make data-driven adjustments during implementation and build support for continued transformation investments.

The resilience benefits of successful digital transformation extend across multiple dimensions of organizational capability. Digital systems often provide greater flexibility and scalability compared to traditional approaches, enabling organizations to adapt more rapidly to changing market conditions. Cloud-based technologies, in particular, offer resilience advantages through geographic distribution, automatic backup capabilities, and scalable resource allocation that can accommodate demand fluctuations.

However, digital transformation also creates new vulnerabilities that organizations must address as part of their resilience planning. Cybersecurity risks, system dependencies, and data privacy concerns represent potential disruption sources that require proactive management. Organizations that successfully navigate digital transformation must balance the efficiency and flexibility benefits of digital systems with appropriate risk management and contingency planning.

The market growth projections for digital transformation indicate continued expansion and evolution of this strategic approach. Forecasts suggest that the digital transformation market will achieve a compound annual growth rate of 16.2% from 2022 to 2027, reflecting widespread recognition of its importance for organizational competitiveness and resilience [43]. This growth trajectory suggests that digital transformation will become increasingly essential for organizational survival and success in disrupted markets.

Supply Chain Diversification and Risk Management

Supply chain resilience has emerged as a critical determinant of organizational survival and competitive advantage, with recent disruptions highlighting the vulnerabilities inherent in highly optimized but fragile supply networks. The evolution from efficiency-focused to resilience-oriented supply chain management represents a fundamental shift in strategic thinking that requires a comprehensive understanding of risk factors, diversification strategies, and performance trade-offs. Organizations that successfully navigate this transition often discover that resilience investments can enhance rather than compromise operational efficiency when properly implemented.

The economic literature provides compelling evidence for the importance of supply chain diversification in building organizational resilience. Research demonstrates that supply chains relying on a broader diversity of input suppliers are more easily able to switch to alternative providers during concentrated shocks to large suppliers [44]. This diversification principle extends beyond simple supplier multiplication to encompass geographic distribution, transportation mode variety, and inventory management sophistication that collectively enhance system robustness.

The limitations of just-in-time supply chain approaches have become increasingly apparent through recent disruption events. Originally designed for production environments where suppliers and manufacturers operated in relative proximity, just-in-time systems assume relatively stable operating conditions with minimal external shocks [45]. The reality of global value chains spanning vast distances and multiple jurisdictions has exposed the fragility of these assumptions, leading many organizations to reconsider their approach to inventory management and supplier relationships.

Geographic diversification represents one of the most effective strategies for enhancing supply chain resilience, though it requires careful balance between risk reduction and cost management. Organizations that concentrate suppliers in single regions or countries face significant vulnerability to localized disruptions, as demonstrated by the impact of the 2011 Japan earthquake on global manufacturing operations [46]. However, geographic diversification must account for total cost of ownership, including transportation expenses, quality considerations, and regulatory compliance requirements that vary across jurisdictions.

Supplier relationship management has evolved beyond traditional procurement practices to encompass strategic partnership development that enhances mutual resilience capabilities. Organizations that invest in long-term supplier relationships often achieve better cooperation during disruptions, including priority access to limited supplies and collaborative problem-solving approaches that benefit both parties [47]. These relationships require ongoing investment in communication, joint planning, and shared risk assessment that extends beyond transactional purchasing arrangements.

Technology integration plays an increasingly important role in supply chain resilience, with digital platforms enabling real-time visibility, predictive analytics, and automated response capabilities that enhance organizational agility. Advanced supply chain management systems can provide early warning signals of potential disruptions, enabling proactive rather than reactive responses to emerging challenges [48]. However, technology integration also creates new dependencies and vulnerabilities that must be addressed through appropriate cybersecurity and system redundancy measures.

Inventory management strategies require fundamental reconsideration in resilience-oriented supply chain design. While excessive inventory carries obvious cost implications, strategic inventory positioning can provide critical buffers during supply disruptions. Research indicates that organizations with strategically positioned safety stock demonstrate superior performance during supply chain disruptions, though optimal inventory levels vary significantly by industry and product characteristics [49].

The measurement and monitoring of supply chain resilience requires sophisticated metrics that go beyond traditional efficiency indicators to encompass adaptability, recovery speed, and disruption impact assessment. The Federal Reserve Bank of New York’s Global Supply Chain Pressure Index provides an example of systematic monitoring that can help organizations anticipate and prepare for supply chain disruptions [50]. Organizations that implement comprehensive monitoring systems can identify emerging risks and adjust their strategies before disruptions reach critical levels.

Leadership and Cultural Adaptation in Disrupted Markets

Leadership effectiveness during market disruptions requires capabilities that extend far beyond traditional management skills, encompassing crisis communication, rapid decision-making, stakeholder engagement, and cultural transformation that enables organizational adaptation. The research evidence consistently demonstrates that leadership quality serves as a primary determinant of organizational survival and success during disruptions, with visionary leadership and clear communication emerging as particularly critical capabilities [51].

The concept of visionary leadership takes on heightened importance during disruptions, when uncertainty and rapid change create anxiety and confusion among stakeholders. Leaders must articulate clear visions of organizational direction while acknowledging the uncertainties inherent in disrupted environments. This balance between confidence and humility requires sophisticated communication skills and a deep understanding of organizational capabilities and market dynamics [52].

Decision-making processes must adapt to the accelerated timelines and incomplete information that characterize disrupted markets. Traditional decision-making approaches that rely on comprehensive analysis and consensus-building often prove inadequate when rapid response is essential for organizational survival. Effective leaders develop frameworks for rapid decision-making that balance speed with quality while maintaining stakeholder confidence and organizational alignment [53].

Employee engagement emerges as a critical factor in organizational resilience, with engaged employees serving as key assets during challenging periods. Research indicates that organizations with high employee engagement levels demonstrate superior performance during disruptions, including higher productivity, lower turnover, and greater innovation in problem-solving approaches [54]. Leaders must invest in professional development, collaborative work environments, and comprehensive well-being support systems that maintain workforce resilience during extended periods of uncertainty.

Cultural transformation often represents the most challenging but essential component of organizational adaptation to disrupted markets. Organizations with cultures that embrace innovation, continuous learning, and calculated risk-taking demonstrate superior performance during disruptions compared to those with rigid, hierarchical cultures [55]. However, cultural change requires sustained leadership commitment and systematic approaches that address values, practices, and organizational structures simultaneously.

Communication strategies must evolve to address the increased frequency and complexity of stakeholder interactions during disruptions. Effective leaders establish regular communication rhythms that provide stakeholders with timely updates while avoiding information overload that can create additional anxiety. Transparency about challenges and uncertainties, balanced with confidence in organizational capabilities, helps maintain stakeholder trust and support during difficult periods [56].

Strategic partnerships and external relationships become increasingly important during disruptions, when organizations must often rely on external resources and expertise to navigate unfamiliar challenges. Leaders must develop and maintain networks of relationships that can provide support, information, and resources during critical periods. These relationships require ongoing investment and reciprocal value creation that extends beyond immediate crisis response needs [57].

Visual Framework for Implementation

The implementation of comprehensive resilience strategies requires visual frameworks that help organizations understand the relationships between different components and track progress across multiple dimensions simultaneously. Effective visual frameworks serve as communication tools, planning guides, and performance monitoring systems that enable coordinated action across complex organizational structures.

The following chart illustrates the relationship between business failure rates and time periods, highlighting the critical importance of early resilience investments:

Digital Transformation success rate varies significantly by organizational characteristic, as illustrated in the following visualization:

Practical Action Plan for Business Leaders

The implementation of comprehensive resilience strategies requires systematic approaches that address immediate vulnerabilities while building long-term adaptive capabilities. The following action plan provides specific steps that business leaders can take to enhance organizational resilience based on the research evidence and best practices identified throughout this analysis.

Phase 1: Assessment and Foundation Building (Months 1-3)

| Action Item | Timeline | Resources Required | Success Metrics |

|---|---|---|---|

| Comprehensive risk assessment | Month 1 | Internal team + external consultant | Complete risk register with impact ratings |

| Financial resilience audit | Month 1 | Finance team + CFO | 90-day cash flow projection |

| Supply chain vulnerability analysis | Month 2 | Operations team + procurement | Supplier dependency mapping |

| Technology resilience review | Month 2 | IT team + security consultant | System redundancy assessment |

| Workforce resilience survey | Month 3 | HR team + survey platform | Employee engagement baseline |

Phase 2: Strategic Planning and Resource Allocation (Months 4-6)

| Action Item | Timeline | Investment Level | Expected Outcomes |

|---|---|---|---|

| Business continuity plan development | Month 4 | Medium | Comprehensive response procedures |

| Financial reserve establishment | Month 4 | High | 90-day operational funding |

| Supplier diversification strategy | Month 5 | Medium | Reduced single-source dependencies |

| Digital transformation roadmap | Month 5 | High | Technology modernization plan |

| Leadership development program | Month 6 | Medium | Enhanced crisis management capabilities |

Phase 3: Implementation and Monitoring (Months 7-12)

The implementation phase requires careful coordination and regular monitoring to ensure that resilience investments deliver expected benefits. Organizations should establish key performance indicators that track both resilience capabilities and operational performance to identify areas requiring adjustment or additional investment.

Regular testing and simulation exercises help validate resilience plans and identify gaps that may not be apparent through planning alone. These exercises should encompass various disruption scenarios and involve all relevant stakeholders to ensure comprehensive preparedness.

Continuous improvement processes enable organizations to refine their resilience strategies based on experience, changing conditions, and emerging best practices. The most resilient organizations treat resilience building as an ongoing capability development process rather than a one-time project.

Future Outlook: Emerging Disruption Patterns

The landscape of market disruptions continues to evolve, with emerging patterns suggesting that future disruptions will be characterized by increased frequency, greater interconnectedness, and accelerated impact timelines. Understanding these emerging patterns is essential for organizations seeking to build resilience strategies that remain effective in rapidly changing environments.

Climate change represents an increasingly significant source of market disruption, with weather-related events expected to become more frequent and severe over the next decade [58]. These disruptions often create cascading effects across multiple industries and geographic regions, requiring comprehensive adaptation strategies that address both direct operational impacts and indirect supply chain consequences.

Technological disruption patterns are accelerating, with artificial intelligence, automation, and digital platforms creating new competitive dynamics across virtually all industries. Organizations must balance the opportunities presented by emerging technologies with the risks of technological obsolescence and the challenges of workforce adaptation [59].

Geopolitical tensions and regulatory changes are creating new sources of market disruption, particularly for organizations with global operations or supply chains. Trade policies, sanctions, and regulatory divergence between jurisdictions require sophisticated risk management approaches that account for political as well as economic factors [60].

The interconnected nature of modern business systems means that future disruptions are likely to have broader and more rapid impacts than historical precedents. Organizations must develop resilience strategies that account for these interconnections and prepare for disruptions that may originate in seemingly unrelated domains.

Key Takeaways

- 90% of businesses fail within a year if they cannot resume operations within 5 days of a major disruption, highlighting the critical importance of business continuity planning and rapid response capabilities.

- Only 30% of digital transformations fully succeed, but organizations with expert-developed business cases achieve 47% success rates, demonstrating the value of strategic planning and external expertise.

- Small companies show 2.7 times higher digital transformation success rates compared to larger enterprises, suggesting that organizational agility provides significant advantages during adaptation efforts.

- Supply chain disruptions contributed to 25% of GDP decline during the pandemic, with shipping costs reaching 1000% of pre-pandemic levels, underscoring the economic significance of supply chain resilience.

- Organizations applying best practices across all resilience dimensions maximize their chances of exceeding performance expectations during recovery periods, emphasizing the importance of comprehensive rather than narrow approaches to resilience building.

Frequently Asked Questions

What is the most critical factor in surviving market disruptions

Research consistently shows that the ability to resume operations within 5 days of a major disruption is the most critical factor, with 90% of businesses failing if they cannot meet this threshold. This highlights the importance of comprehensive business continuity planning and rapid response capabilities.

Why do smaller companies have higher digital transformation success rates?

Smaller organizations demonstrate 2.7 times higher success rates due to greater organizational agility, faster decision-making processes, and reduced complexity in change management initiatives. They can adapt more quickly to new technologies and processes without the bureaucratic constraints that often hinder larger organizations.

How much should organizations invest in financial reserves for resilience?

Research indicates that organizations should maintain financial reserves sufficient to cover 90 days of operations without revenue. However, the optimal reserve level varies by industry, with service-based businesses typically requiring smaller reserves than manufacturing or inventory-intensive operations.

What role does leadership play in organizational resilience?

Leadership quality serves as a primary determinant of organizational survival during disruptions. Visionary leadership, clear communication, and decisive decision-making are particularly critical capabilities that enable organizations to navigate uncertainty and maintain stakeholder confidence.

How can organizations balance efficiency with resilience in supply chain management?

Organizations must move beyond just-in-time approaches to embrace supply chain diversification, strategic inventory positioning, and supplier relationship development. While this may increase costs in the short term, resilient supply chains often provide competitive advantages and cost savings during disruptions.

References

- Risk and Resilience Hub – Business Continuity Statistics

- White House CEA – Supply Chain Resilience Issue Brief

- McKinsey – Unlocking Success in Digital Transformations

- Federal Reserve – Trade Disruptions and Inflation

- MIT Professional Programs – Product Innovation Statistics

- Economic Development Administration – Economic Resilience

- Small Business Administration – Business Resilience Guide

- ScienceDirect – Economic Resilience Analysis

- Federal Reserve – Trade Disruptions and Inflation

- IEEE Transactions – Market Strategies for Disruptive Technologies

- Vena Solutions – Business Failure Statistics

- Risk and Resilience Hub – Business Continuity Statistics

- ScienceDirect – Economic Resilience Analysis

- Mooncamp – Digital Transformation Statistics

- McKinsey – Unlocking Success in Digital Transformations

- Market Disruptions Source

- Gartner – Technology Disruptions

- McKinsey – Business Resilience