The professional services industry, employing over 23 million Americans and generating $72.61 billion globally in 2024, stands at a critical transformation point. While software-as-a-service startups command valuations of 6-8 times annual revenue, traditional productizing professional services firms struggle with valuations of just 1-2 times revenue—a disparity that reflects fundamental differences in scalability and margin structure. Service productization offers a proven pathway to bridge this gap, transforming variable, labor-intensive services into standardized, scalable offerings that deliver predictable, recurring revenue. Leading firms like Littler Mendelson and Bahwan CyberTek have demonstrated that strategic productization can unlock exponential growth, with the global professional services market projected to reach $95.44 billion by 2029 at a 5.62% compound annual growth rate.

Why Productization Matters in 2025

The professional services landscape has reached an inflection point where traditional business models face unprecedented pressure from evolving client expectations, technological disruption, and competitive dynamics. According to the U.S. Bureau of Labor Statistics, the professional and business services supersector employs 22.6 million Americans as of July 2025, with average hourly earnings of $44.36, representing one of the largest and most economically significant sectors in the American economy [1]. Yet despite this massive scale, the industry confronts fundamental challenges that threaten long-term sustainability and growth potential.

The valuation gap between product-based and service-based businesses reveals the market’s assessment of scalability limitations inherent in traditional professional services models. Research from MIT Sloan Management Review demonstrates that software-as-a-service startups typically achieve valuations of 6-8 times annual revenue, while project-based professional services firms struggle to exceed 1-2 times revenue multiples [2]. This disparity reflects the market’s recognition that service businesses face linear scaling challenges, where revenue growth requires proportional increases in headcount, limiting both profitability and growth potential.

Market dynamics further underscore the urgency for transformation. Statista projects the global professional services market will grow from $72.61 billion in 2024 to $95.44 billion by 2029, representing a compound annual growth rate of 5.62% [3]. However, this growth occurs within an increasingly competitive environment where clients demand greater value, transparency, and predictability. North American businesses, which account for 35.4% of the global professional services market, face particular pressure from digital-native competitors who leverage technology to deliver superior client experiences at lower costs.

The employment landscape within professional services reveals both opportunities and challenges. Technology and IT consulting represent 31.1% of professional services work in the Americas, followed by business and management consulting at 29.6% [4]. Notably, subscription services already account for 7% of the market, indicating early adoption of recurring revenue models. This distribution suggests significant potential for productization across multiple service categories, particularly in areas where standardization and automation can enhance delivery efficiency.

Compensation trends within the industry highlight the premium placed on specialized expertise. Management consulting professionals earn an average of $156,200 annually, while legal professionals average $150,400 [5]. These high compensation levels, while reflecting the value of professional expertise, also create pressure for firms to maximize utilization and efficiency. Productization offers a pathway to leverage this expertise more effectively by embedding knowledge into scalable systems and processes.

| Metric | Value | Source |

|---|---|---|

| Global Market Revenue (2024) | $72.61 billion | Statista |

| Projected Market Volume (2029) | $95.44 billion | Statista |

| Annual Growth Rate (CAGR 2024-2029) | 5.62% | Statista |

| US Employment (June 2024) | 23 million | BLS |

| Average Annual Wage (US) | $86,000 | BLS |

| North American Market Share | 35.4% | Industry Report |

The workforce characteristics of professional services further emphasize the sector’s knowledge-intensive nature. According to the UK’s Office for National Statistics, professional services maintain the most highly qualified workforce of all industries, with a qualification index score of 3.49 out of 4, and approximately 70% of workers holding higher education qualifications [6]. This concentration of expertise represents both an asset and a challenge—while it enables high-value service delivery, it also creates dependencies that limit scalability and increase operational risk.

Understanding Service Productization

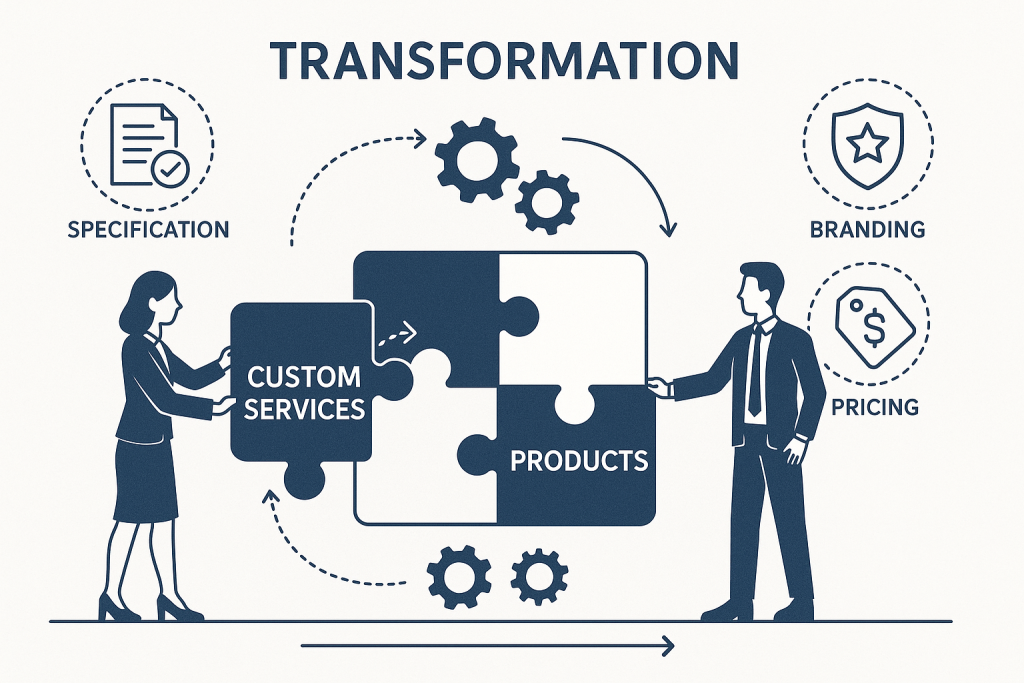

Service productization represents a fundamental transformation in how professional services firms conceptualize, deliver, and scale their offerings. Academic research published in the Journal of Business Research defines service productization as the process of transforming variable, ad-hoc services into well-defined service products that are specified, branded, and priced [7]. This transformation moves beyond simple standardization to create tangible, repeatable offerings that clients can easily understand, evaluate, and purchase.

The conceptual framework for service productization rests on three foundational characteristics that distinguish productized services from traditional consulting engagements. First, productized services must be specified, meaning they have a formalized value proposition and are configured, standardized, and systematized. This specification eliminates the ambiguity that often characterizes custom consulting projects, providing clear boundaries and expectations for both provider and client. Second, these services must be branded, incorporating distinctive names, terms, symbols, or designs that make them identifiable through linguistic, visual, and tangible cues. Finally, productized services feature clearly stated, communicated, and committed prices that can include rate factors and timing, eliminating the need for custom proposals and lengthy negotiation cycles.

MIT Sloan Management Review’s analysis reveals that productization involves “automating, standardizing, and packaging aspects of a service into a tangible, repeatable, and scalable offering that is efficient to produce and easier to scale” [8]. This definition emphasizes the operational transformation required to move from labor-intensive, customized delivery to systematic, technology-enabled service provision. The process fundamentally alters the economics of service delivery by reducing variable costs and enabling economies of scale previously unavailable to professional services firms.

Real-world implementations demonstrate the transformative potential of strategic productization. Littler Mendelson, the largest labor and employment law firm in the United States, exemplifies successful service productization through its Littler CaseSmart platform. This proprietary system combines case management technology with a network of specialized attorneys to deliver legal services more efficiently while providing clients with predictable cost structures and faster access to case information and analytics [9]. The platform’s dashboard offers real-time tracking of legal matters, documents, and deadlines, while providing insights into litigation trends that help clients make more informed strategic decisions.

The transformation journey from custom services to productized offerings often spans multiple years and requires significant organizational commitment. Bahwan CyberTek’s development of FuelTrans illustrates this evolution. Beginning in 2013 as a bespoke IT services project for Oman Oil Marketing Company, BCT gradually standardized and productized its solution to address common challenges in oil retail operations. By 2015, they had developed FuelTrans as a standardized product that integrated fuel station automation, supply chain management, logistics, and convenience store operations. This productization enabled BCT to scale rapidly across multiple markets, ultimately deploying FuelTrans to over 13,500 stations worldwide and achieving the position of fourth-largest player in fuel system automation globally [10].

| Service Type | Market Share | Productization Potential |

|---|---|---|

| Technology/IT Consulting | 31.1% | High – Standardizable processes and tools |

| Business & Management Consulting | 29.6% | Medium – Framework-based methodologies |

| Managed Services | 13.0% | High – Already service-product hybrid |

| Subscription Services | 7.0% | Very High – Inherently productized model |

| Staff Augmentation | 5.2% | Low – Human resource dependent |

| Hardware/Software/Equipment | 3.2% | Very High – Physical product integration |

| Other Services | 10.8% | Variable – Depends on service type |

The distinction between traditional services and productized offerings becomes apparent when examining delivery methodologies and client interactions. Traditional professional services typically involve extensive discovery phases, custom solution development, and variable project timelines that depend on client-specific requirements and unforeseen complications. In contrast, productized services leverage pre-defined methodologies, standardized deliverables, and predictable timelines that enable more accurate project planning and resource allocation.

However, productization does not necessarily mean complete standardization or the elimination of professional judgment. Successful productized services often incorporate configurable elements that allow for customization within defined parameters. This approach maintains the flexibility that clients value while capturing the efficiency benefits of standardization. For example, a productized cybersecurity assessment might include standard evaluation criteria and reporting formats while allowing for industry-specific customizations or varying levels of depth based on client size and complexity.

The academic literature identifies several critical success factors for effective service productization. Research indicates that firms must carefully balance standardization with customization, ensuring that productized offerings meet diverse client needs without sacrificing operational efficiency [11]. Additionally, successful productization requires significant investment in technology infrastructure, process documentation, and staff training to support consistent delivery across multiple client engagements.

The Business Case for Transformation

The financial imperative for service productization becomes evident when examining the performance differentials between traditional service delivery models and productized alternatives. McKinsey & Company’s research on experience-led growth demonstrates that companies implementing successful customer experience strategies—which often include service productization elements—achieve more than double the revenue growth of their competitors between 2016 and 2021 [12]. Furthermore, growth outperformers deliver 30% higher total return to shareholders and nearly double the shareholder value compared to industry peers, highlighting the substantial financial benefits available to firms that successfully transform their service delivery models.

The revenue impact of productization manifests through multiple channels that compound to create significant competitive advantages. McKinsey’s analysis reveals that successful experience-led growth strategies, which increase customer satisfaction by at least 20%, can deliver cross-sell rate increases of 15-25%, share of wallet improvements of 5-10%, and customer satisfaction and engagement enhancements of 20-30% [13]. These metrics translate directly to financial performance improvements, as productized services enable firms to expand relationships with existing clients more effectively than traditional project-based engagements.

The cost structure advantages of productization become particularly pronounced when examining operational efficiency gains. Traditional professional services face the challenge of linear scaling, where revenue growth requires proportional increases in headcount and associated overhead costs. Productized services break this linear relationship by leveraging technology, standardized processes, and reusable intellectual property to serve multiple clients simultaneously. This operational leverage enables firms to achieve gross margins of 60-90%, compared to the industry standard of approximately 40% for customized professional services [14].

Client value perception represents another critical dimension of the business case for productization. Research indicates that clients appreciate well-branded, clearly defined packages that eliminate ambiguity about deliverables, timelines, and costs. This transparency builds trust and reduces the sales cycle length, as clients can more easily evaluate and compare offerings without requiring extensive custom proposals. The predictability inherent in productized services also reduces client risk perception, making it easier to secure larger engagements and longer-term commitments.

| Business Model | Valuation Multiple | Gross Margin | Scalability | Revenue Predictability |

|---|---|---|---|---|

| SaaS Products | 6-8x annual revenue | 60-90% | Exponential | High (recurring) |

| Productized Services | 3-5x annual revenue | 50-70% | High | Medium-High |

| Traditional Services | 1-2x annual revenue | ~40% | Linear | Low (project-based) |

The risk mitigation benefits of productization extend beyond financial performance to encompass operational resilience and market positioning. Traditional professional services firms face significant concentration risk, as their success depends heavily on key personnel and client relationships. Productization distributes this risk by embedding knowledge and processes into systematic approaches that reduce dependence on individual expertise. This systematization also enables more consistent quality delivery, as standardized processes and quality controls replace variable individual performance.

Market positioning advantages emerge from the ability to clearly communicate value propositions and differentiate offerings in competitive situations. Productized services enable firms to develop distinctive market positions based on specific capabilities, methodologies, or technology platforms. This differentiation becomes particularly valuable in commoditized service categories where price competition erodes margins. By creating unique, branded offerings, firms can command premium pricing while reducing competitive pressure.

The customer acquisition cost benefits of productization reflect the efficiency gains in sales and marketing processes. Traditional professional services require extensive relationship building, custom proposal development, and lengthy sales cycles that can span months or years. Productized services streamline these processes by providing clear value propositions, standardized pricing, and proven track records that reduce client evaluation time. McKinsey’s research indicates that compensating for one lost customer can require the acquisition of three new customers, emphasizing the importance of retention-focused strategies that productization enables [15].

However, the business case for productization must also acknowledge potential limitations and challenges. Academic research identifies several risks associated with highly productized services, including reduced flexibility to address unique client requirements, potential commoditization of previously differentiated offerings, and the substantial upfront investment required for technology development and process standardization [16]. Successful firms must carefully balance these considerations to optimize the level of productization appropriate for their market position and client base.

The timing of productization initiatives can significantly impact their success and return on investment. Market conditions, competitive dynamics, and internal capabilities all influence the optimal approach to service transformation. Firms operating in mature markets with established client relationships may face different challenges than those entering new markets or serving emerging client segments. Understanding these contextual factors is essential for developing realistic expectations and appropriate investment strategies.

Financial modeling for productization initiatives must account for both the upfront investment requirements and the longer-term revenue and margin benefits. Typical productization projects require 12-24 months to achieve meaningful market traction, with full benefits often taking 3-5 years to materialize. This timeline requires patient capital and sustained organizational commitment, particularly during the transition period when traditional revenue streams may decline before productized offerings achieve scale.

Implementation Framework

Successful service productization requires a systematic approach that addresses both technical and organizational challenges inherent in transforming traditional service delivery models. MIT Sloan Management Review’s research identifies a comprehensive five-step framework that provides structure for firms undertaking productization initiatives [17]. This framework acknowledges that productization represents a fundamental business model transformation rather than a simple operational adjustment, requiring sustained commitment and strategic alignment across multiple organizational dimensions.

The first step, assessing product potential, involves evaluating the extent to which existing services can be productized without compromising their essential value proposition. This assessment requires analyzing service delivery processes to identify standardizable components, evaluating market demand for productized alternatives, and determining the technical feasibility of automation or systematization. Firms must honestly evaluate whether their services possess sufficient repeatability and structure to support productization, as some highly customized or relationship-dependent services may not be suitable candidates for transformation.

During the assessment phase, organizations should conduct comprehensive market research to understand client preferences regarding standardized versus customized service delivery. This research often reveals surprising insights about client willingness to accept standardization in exchange for reduced costs, faster delivery, or improved predictability. Additionally, competitive analysis helps identify market gaps where productized services could create distinctive positioning advantages.

The second step, deciding the optimal productization level, requires determining the appropriate balance between standardization and customization for specific service offerings. This decision significantly impacts both operational efficiency and market acceptance, as excessive standardization may alienate clients who value customized approaches, while insufficient standardization may fail to capture the efficiency benefits that justify productization investments. Successful firms often adopt a modular approach that combines standardized core components with configurable elements that address specific client requirements.

| Phase | Duration | Key Activities | Success Metrics | Investment Level |

|---|---|---|---|---|

| 1. Assess Product Potential | 2-3 months | Market analysis, capability assessment, feasibility study | Feasibility score, market size estimate | Low |

| 2. Define Productization Level | 1-2 months | Scope definition, standardization planning | Product specification document | Low |

| 3. Design Offering Portfolio | 3-4 months | Package development, pricing strategy | Product catalog, pricing model | Medium |

| 4. Build Product Capabilities | 6-12 months | Technology development, process automation | Platform functionality, efficiency gains | High |

| 5. Lead Transformation | 12-24 months | Organizational change, market launch | Revenue growth, client adoption | High |

The third step, defining the offering portfolio, involves creating a coherent set of productized services that address different client segments and use cases. This portfolio design must consider client journey mapping, competitive positioning, and internal capability constraints. Successful portfolio strategies often include multiple service tiers that provide upgrade paths for clients while maximizing revenue per relationship. The portfolio design phase also requires developing pricing strategies that reflect the value delivered while remaining competitive with alternative solutions.

Portfolio development benefits from adopting a platform approach that enables multiple service offerings to share common infrastructure, processes, and technology components. This shared foundation reduces development costs while enabling faster time-to-market for new offerings. Platform thinking also facilitates future expansion into adjacent service areas or market segments by leveraging existing capabilities and client relationships.

The fourth step, building product capabilities, represents the most resource-intensive phase of productization, requiring significant investments in technology infrastructure, process documentation, and staff training. This phase often involves developing proprietary software platforms, creating standardized methodologies, and establishing quality assurance processes that ensure consistent delivery across multiple client engagements. The technology development component frequently requires external partnerships or acquisitions to access specialized capabilities that may not exist within traditional professional services organizations.

Capability building must address both client-facing and internal operational requirements. Client-facing capabilities include user interfaces, reporting systems, and communication tools that enhance the service experience. Internal capabilities encompass project management systems, resource allocation tools, and performance monitoring dashboards that enable efficient service delivery at scale. The integration of these capabilities often requires significant organizational change management to ensure adoption and effective utilization.

The fifth step, leading the transformation, focuses on organizational design and change management required to support productized service delivery. This transformation typically involves restructuring teams around product lines rather than functional specialties, developing new performance metrics and incentive systems, and creating career paths that support both product development and service delivery roles. The cultural transformation from a project-based to a product-based mindset often represents the most challenging aspect of productization initiatives.

Organizational transformation requires addressing several critical challenges that can undermine productization efforts. Traditional professional services cultures emphasize individual expertise, client relationships, and custom solution development—values that may conflict with the standardization and systematization required for successful productization. Leadership must actively communicate the strategic rationale for transformation while providing support and training to help staff adapt to new ways of working.

The change management process must also address compensation and incentive structures that align with productized service delivery. Traditional professional services firms typically compensate based on billable hours, individual client relationships, and project profitability—metrics that may discourage the collaboration and knowledge sharing required for effective productization. New incentive structures should reward contributions to product development, client satisfaction improvements, and operational efficiency gains that support long-term business success.

Risk management throughout the implementation process requires careful attention to both internal and external factors that could derail productization efforts. Internal risks include resistance to change, inadequate technology infrastructure, and insufficient investment in capability development. External risks encompass competitive responses, market acceptance challenges, and economic conditions that may affect client demand for productized services. Successful firms develop contingency plans that address these risks while maintaining momentum toward productization objectives.

Technology and Automation

Technology serves as the fundamental enabler of service productization, providing the infrastructure and capabilities necessary to standardize, scale, and systematize professional service delivery. The integration of technology into service processes transforms labor-intensive, variable-cost operations into capital-intensive, fixed-cost systems that can serve multiple clients simultaneously without proportional increases in human resources. This technological transformation represents a critical success factor that distinguishes successful productization initiatives from failed attempts at simple standardization.

Automation opportunities within professional services span multiple dimensions, from client interaction and project management to quality assurance and reporting. Customer relationship management systems enable standardized client onboarding processes, automated communication workflows, and systematic tracking of engagement progress. Project management platforms facilitate resource allocation, timeline management, and deliverable tracking across multiple concurrent engagements. These systems create operational leverage that enables firms to manage larger client portfolios without proportional increases in administrative overhead.

Artificial intelligence and machine learning technologies increasingly enable the automation of knowledge work that previously required human expertise. Document analysis, pattern recognition, and predictive modeling capabilities allow firms to automate routine analytical tasks while focusing human expertise on higher-value strategic activities. For example, legal technology platforms can automatically review contracts for standard clauses and compliance issues, enabling attorneys to focus on complex legal strategy rather than routine document review.

Platform development strategies must balance functionality, usability, and scalability requirements while managing development costs and timelines. Successful platforms often adopt modular architectures that enable incremental capability development and customization for different client segments or service offerings. This modular approach reduces initial development costs while providing flexibility for future expansion and enhancement. Cloud-based infrastructure provides scalability and reliability advantages while reducing the capital investment required for technology deployment.

Integration considerations become particularly important when productized services must interface with client systems or third-party platforms. Application programming interfaces (APIs) enable seamless data exchange and workflow integration that enhance the client experience while reducing manual intervention requirements. However, integration complexity can significantly increase development costs and timelines, requiring careful evaluation of integration requirements during the platform design phase.

Data analytics capabilities represent a critical differentiator for productized services, enabling firms to provide insights and recommendations that extend beyond traditional service delivery. Analytics platforms can identify patterns, trends, and optimization opportunities that add value for clients while creating competitive advantages for service providers. The accumulation of data across multiple client engagements enables continuous improvement of service delivery processes and the development of predictive capabilities that enhance client outcomes.

Security and compliance requirements often drive significant technology investment, particularly for firms serving regulated industries or handling sensitive client information. Cybersecurity frameworks, data encryption, access controls, and audit trails become essential components of productized service platforms. These security investments, while costly, often provide competitive advantages by enabling firms to serve enterprise clients with stringent security requirements.

The technology adoption process requires careful change management to ensure effective utilization by both internal staff and clients. User experience design becomes critical for client-facing systems, as poor usability can undermine the value proposition of productized services. Training programs, documentation, and ongoing support services help ensure successful technology adoption while minimizing disruption to existing client relationships.

Technology partnerships and vendor relationships often provide access to specialized capabilities that would be prohibitively expensive to develop internally. Software-as-a-service platforms, cloud infrastructure providers, and specialized technology vendors can accelerate productization timelines while reducing development risks. However, vendor dependencies also create strategic risks that must be carefully managed through contract terms, service level agreements, and contingency planning.

Measuring Success and ROI

Effective measurement of productization success requires a comprehensive framework that captures both financial and operational performance indicators while accounting for the multi-year timeline typically required for full transformation benefits to materialize. Traditional professional services metrics, such as billable hours and utilization rates, become less relevant in productized environments where value creation depends more on client outcomes and operational efficiency than on time-based billing. Organizations must develop new measurement approaches that align with productized service delivery models and support continuous improvement initiatives.

Financial performance metrics for productized services should emphasize recurring revenue, client lifetime value, and margin improvement rather than project-based profitability measures. Net revenue retention (NRR) becomes a critical indicator, measuring the percentage of recurring revenue retained from existing customers over specific time periods. McKinsey research identifies NRR as a key metric for measuring customer behavior changes and the effectiveness of experience-led growth strategies [18]. Successful productized services typically achieve NRR rates above 100%, indicating that revenue expansion from existing clients exceeds any revenue loss from client departures.

Client satisfaction and engagement metrics provide leading indicators of long-term financial performance while identifying opportunities for service improvement. Customer satisfaction scores, Net Promoter Scores (NPS), and client retention rates help organizations understand the market acceptance of productized offerings. Research indicates that successful experience-led growth strategies can improve customer satisfaction and engagement by 20-30%, providing a benchmark for evaluating productization effectiveness [19].

Operational efficiency indicators measure the extent to which productization achieves its primary objective of enabling scalable service delivery. Key metrics include revenue per employee, client-to-staff ratios, and service delivery cycle times. These metrics help organizations understand whether productization is successfully reducing the labor intensity of service delivery while maintaining or improving quality standards. Successful productization initiatives typically demonstrate improving trends across these operational metrics over 12-24 month periods.

| Category | Metric | Target Range | Measurement Frequency |

|---|---|---|---|

| Financial | Net Revenue Retention (NRR) | 100-120% | Quarterly |

| Gross Margin | 50-70% | Monthly | |

| Customer Lifetime Value (CLV) | 3-5x acquisition cost | Quarterly | |

| Client Experience | Net Promoter Score (NPS) | 50+ | Quarterly |

| Customer Satisfaction Score | 4.0+ (5-point scale) | Monthly | |

| Client Retention Rate | 90%+ | Annually | |

| Operational | Revenue per Employee | $200K-$400K | Quarterly |

| Service Delivery Cycle Time | 20-40% reduction | Monthly | |

| Utilization Rate | 70-85% | Weekly |

Quality metrics ensure that efficiency gains do not compromise service effectiveness or client outcomes. Quality indicators might include error rates, rework requirements, client feedback scores, and outcome achievement rates. These metrics help organizations maintain the balance between standardization and quality that is essential for long-term success in productized service delivery.

Your Productization Roadmap

Implementing service productization requires a systematic approach that addresses strategic, operational, and organizational dimensions while managing the risks inherent in business model transformation. The following roadmap provides a practical framework for organizations considering productization initiatives, incorporating lessons learned from successful implementations and common pitfalls that can derail transformation efforts.

Phase 1: Strategic Assessment and Planning (Months 1-3)

Begin with a comprehensive assessment of your current service portfolio to identify productization candidates. Evaluate services based on repeatability, standardization potential, market demand, and competitive positioning. Services with high repeatability and clear value propositions typically represent the best initial candidates for productization. Conduct market research to understand client preferences regarding standardized versus customized service delivery, and analyze competitive offerings to identify differentiation opportunities.

Develop a business case that quantifies the investment requirements and expected returns from productization. Include technology development costs, organizational change expenses, and potential revenue impacts in your financial modeling. Establish success metrics and timelines that reflect the multi-year nature of productization initiatives while providing interim milestones that demonstrate progress.

Phase 2: Product Design and Development (Months 4-8)

Design your productized service offerings with clear specifications, pricing models, and delivery processes. Create detailed service descriptions that eliminate ambiguity about deliverables, timelines, and client responsibilities. Develop pricing strategies that reflect the value delivered while remaining competitive with alternative solutions. Consider tiered pricing models that provide upgrade paths for clients while maximizing revenue per relationship.

Invest in technology infrastructure that supports scalable service delivery. This may include customer relationship management systems, project management platforms, automation tools, and client-facing interfaces. Prioritize user experience design for client-facing systems, as poor usability can undermine the value proposition of productized services.

Phase 3: Pilot Implementation (Months 9-12)

Launch pilot programs with selected clients to test productized service delivery and refine processes based on real-world feedback. Choose pilot clients who are open to innovation and willing to provide constructive feedback about their experience. Use pilot results to identify process improvements, technology enhancements, and training requirements before broader market launch.

Develop internal capabilities through training programs, process documentation, and performance management systems that support productized service delivery. Address cultural change requirements by communicating the strategic rationale for productization and providing support for staff adapting to new ways of working.

Phase 4: Market Launch and Scaling (Months 13-24)

Execute a coordinated market launch that includes sales training, marketing materials, and client communication strategies. Develop case studies and success stories from pilot implementations to support sales efforts. Monitor key performance indicators closely during the launch phase to identify issues early and make necessary adjustments.

Scale operations systematically while maintaining quality standards and client satisfaction. This may require additional technology investments, staff hiring, or process refinements based on increased volume and complexity. Establish feedback loops that enable continuous improvement of productized service offerings based on client experience and operational performance.

Common Pitfalls to Avoid

- Insufficient upfront investment: Underestimating technology and process development requirements can lead to poor client experiences and competitive disadvantages.

- Inadequate change management: Failing to address cultural and organizational changes required for productized service delivery often results in internal resistance and implementation failures.

- Over-standardization: Eliminating all customization can alienate clients who value tailored approaches, particularly in complex or specialized service areas.

- Poor pricing strategy: Pricing productized services too low can undermine profitability, while pricing too high can limit market acceptance and adoption.

- Technology complexity: Developing overly complex technology platforms can increase costs and timelines while creating usability challenges for both staff and clients.

The Future of Professional Services

The professional services industry stands at the threshold of a fundamental transformation driven by technological advancement, changing client expectations, and competitive pressures that favor scalable, efficient service delivery models. Industry projections indicate continued growth, with the global professional services market expected to reach $95.44 billion by 2029, representing a compound annual growth rate of 5.62% [20]. However, this growth will likely concentrate among firms that successfully adapt to evolving market dynamics through productization and digital transformation initiatives.

Artificial intelligence and automation technologies will increasingly enable the productization of knowledge-intensive services that previously required extensive human expertise. Machine learning algorithms can analyze patterns, generate insights, and make recommendations that augment human capabilities while reducing the time and cost required for service delivery. This technological evolution will create opportunities for firms to productize higher-value services while potentially displacing traditional consulting approaches in routine or standardized areas.

Client expectations continue to evolve toward greater transparency, predictability, and value demonstration in professional service relationships. The subscription economy model, which already accounts for 7% of professional services work in the Americas, will likely expand as clients seek more predictable cost structures and ongoing value delivery rather than project-based engagements [21]. This trend favors firms that can demonstrate continuous value creation through productized service offerings.

Competitive dynamics will increasingly favor firms that can combine deep expertise with scalable delivery models. Traditional competitive advantages based on relationships and individual expertise will become less sustainable as clients prioritize outcomes and efficiency over personal connections. Firms that successfully productize their services will be better positioned to compete on value and results rather than relationships and reputation alone.

However, the future landscape will also present challenges that firms must navigate carefully. The risk of commoditization increases as services become more standardized and comparable across providers. Firms must maintain differentiation through innovation, specialized expertise, or superior execution while capturing the efficiency benefits of productization. Additionally, the investment requirements for technology development and organizational transformation may create barriers for smaller firms, potentially leading to industry consolidation.

Regulatory and compliance requirements will continue to influence productization strategies, particularly in highly regulated industries such as financial services, healthcare, and legal services. Firms must balance standardization benefits with the flexibility required to address evolving regulatory requirements and client-specific compliance needs. This balance may favor modular productization approaches that combine standardized core components with configurable compliance elements.

Key Takeaways

- Market Opportunity: The $72.61 billion professional services market offers significant productization opportunities, with successful transformations achieving 6-8x revenue multiples compared to 1-2x for traditional services.

- Financial Impact: Productization can increase cross-sell rates by 15-25%, boost share of wallet by 5-10%, and improve customer satisfaction by 20-30% while achieving gross margins of 50-70%.

- Implementation Timeline: Successful productization typically requires 12-24 months for meaningful results, with full benefits materializing over 3-5 years through systematic implementation of MIT’s five-step framework.

- Technology Enablement: Technology infrastructure and automation capabilities serve as critical success factors, enabling scalable service delivery and operational leverage that traditional models cannot achieve.

- Organizational Transformation: Cultural change management and new performance metrics are essential for successful productization, requiring sustained leadership commitment and staff development investments.

Frequently Asked Questions

What types of professional services are best suited for productization?

Services with high repeatability, standardizable processes, and clear value propositions typically offer the best productization potential. Technology consulting, managed services, and subscription-based offerings represent particularly strong candidates, while highly customized or relationship-dependent services may be less suitable.

How long does service productization typically take to implement?

Most productization initiatives require 12-24 months to achieve meaningful market traction, with full benefits often taking 3-5 years to materialize. The timeline depends on service complexity, technology requirements, and organizational change management needs.

What are the typical investment requirements for productization?

Investment requirements vary significantly based on technology complexity and organizational scope, but typically include technology development costs, process documentation expenses, staff training investments, and potential revenue impacts during the transition period. Firms should budget for sustained investment over multiple years.

How can firms maintain service quality while standardizing delivery processes?

Successful firms adopt modular approaches that combine standardized core components with configurable elements that address specific client requirements. Quality assurance processes, performance monitoring, and continuous improvement initiatives help maintain standards while capturing efficiency benefits.

What are the biggest risks associated with service productization?

Key risks include over-standardization that alienates clients, insufficient technology investment leading to poor user experiences, inadequate change management causing internal resistance, and competitive responses that erode market positioning. Careful planning and risk management can mitigate these challenges.

References

- U.S. Bureau of Labor Statistics. Professional and Business Services Industry Overview.

- MIT Sloan Management Review. How to Turn Professional Services Into Products.

- Runn.io. The State of Professional Services: Statistics and Market Trends.

- Ibid.

- U.S. Bureau of Labor Statistics. Professional and Business Services Industry Overview.

- UK Office for National Statistics. Professional Services Workforce Analysis.

- Wirtz, J., et al. Service products and productization. Journal of Business Research, 2021.

- MIT Sloan Management Review. How to Turn Professional Services Into Products.

- Ibid.

- Ibid.

- Wirtz, J., et al. Service products and productization. Journal of Business Research, 2021.

- McKinsey & Company. Experience-led growth: A new way to create value.

- Ibid.

- MIT Sloan Management Review. How to Turn Professional Services Into Products.

- McKinsey & Company. Experience-led growth: A new way to create value.

- Wirtz, J., et al. Service products and productization. Journal of Business Research, 2021.

- MIT Sloan Management Review. How to Turn Professional Services Into Products.

- McKinsey & Company. Experience-led growth: A new way to create value.

- Ibid.

- Runn.io. The State of Professional Services: Statistics and Market Trends.

- Ibid.