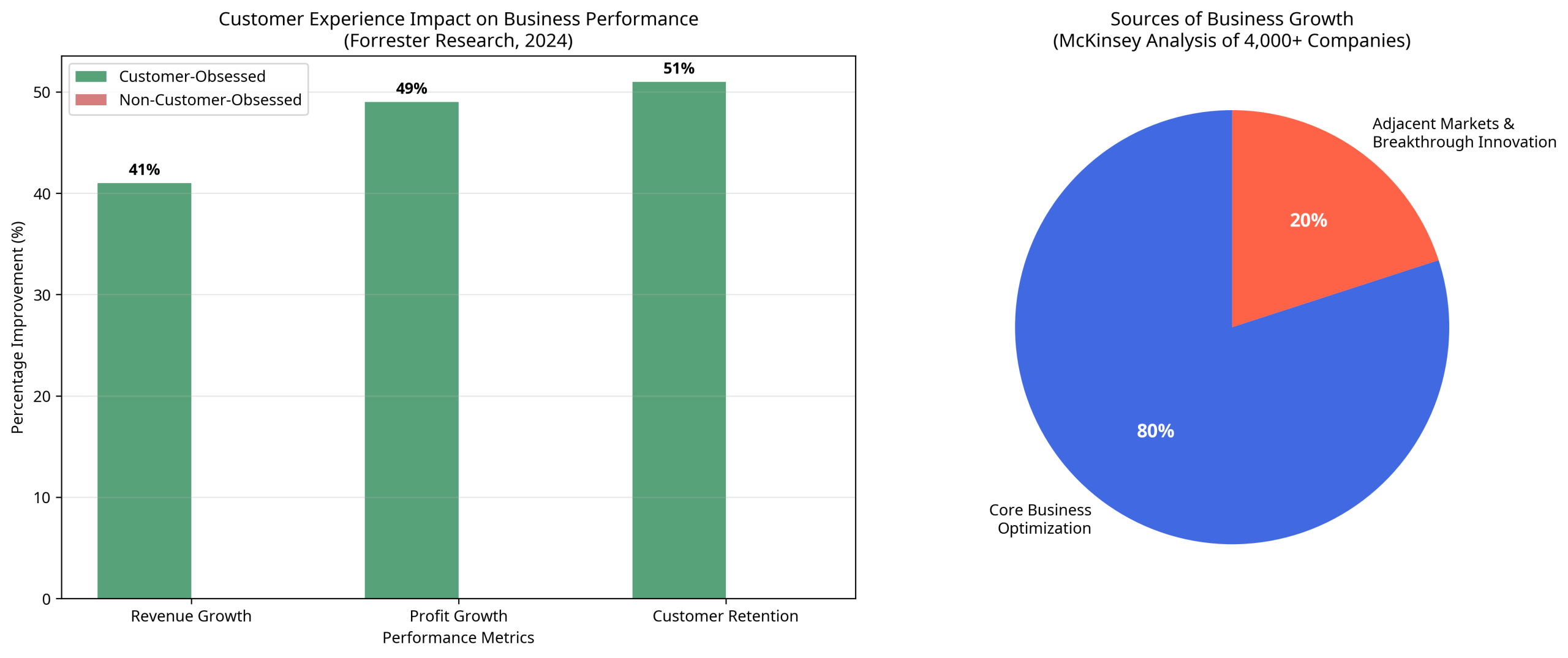

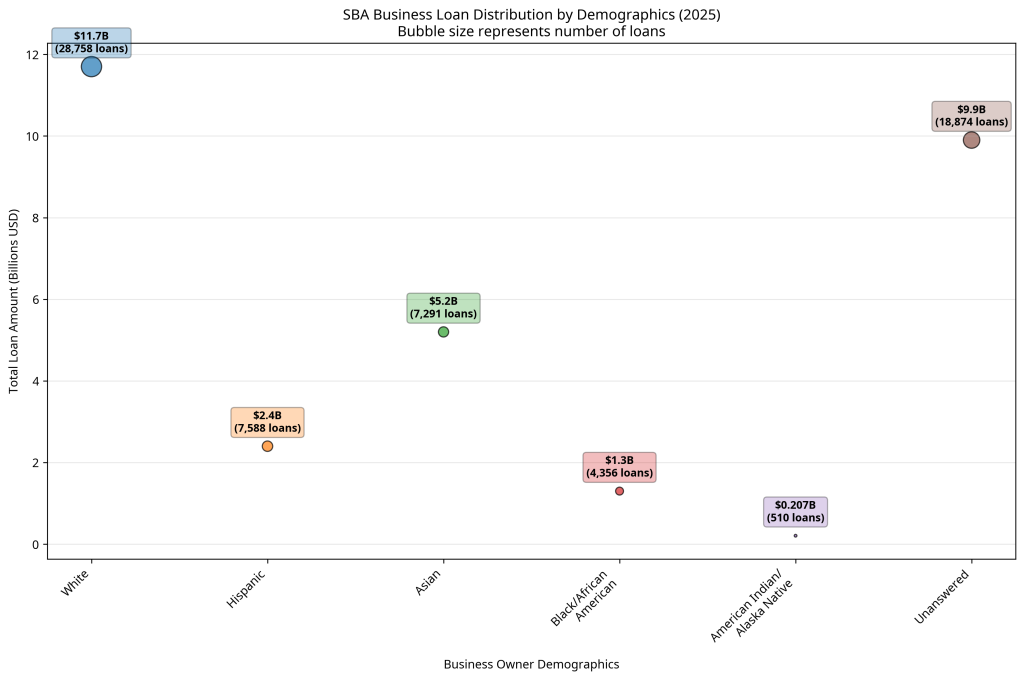

In today’s challenging economic landscape, only 25% of companies achieve sustainable growth over time, according to McKinsey’s comprehensive analysis of over 4,000 global organizations. Yet businesses that master proven growth strategies can achieve remarkable results: customer-obsessed companies report 41% faster revenue growth and 49% faster profit growth than their competitors. With $30.8 billion in small business loans approved by the SBA in 2025 alone, representing 67,377 individual growth investments, the data reveals clear patterns of what drives business success. This analysis examines eight evidence-based strategies that consistently accelerate business growth, backed by authoritative research from government agencies, leading consulting firms, and academic institutions.

Why Business Growth Matters More Than Ever in 2025

The imperative for business growth has intensified dramatically in recent years, driven by unprecedented economic volatility and rapidly evolving market conditions. Research from McKinsey demonstrates that companies maintaining a “through-cycle growth mindset” significantly outperform those that retreat during challenging periods. During the financial crisis, the performance gap between growth-focused companies and those maintaining only core operations was initially narrow, but this gap widened substantially as economic conditions stabilized, creating lasting competitive advantages for bold organizations.

The current business environment presents unique challenges that make strategic growth essential rather than optional. Forrester’s 2024 Customer Experience Index reveals that customer experience quality has reached an all-time low after declining for three consecutive years, with 39% of brands experiencing deterioration in customer relationships. This deterioration creates both risks for complacent organizations and opportunities for those implementing effective growth strategies.

Furthermore, the acceleration of digital transformation and changing consumer expectations has compressed traditional business cycles. Companies can no longer rely on periodic growth spurts; instead, they must develop capabilities for continuous adaptation and expansion. The Small Business Administration’s lending data shows that businesses are responding to this challenge, with average loan sizes of $457,078 indicating substantial investments in growth initiatives. This level of capital deployment suggests that successful businesses recognize growth as a strategic necessity, not a luxury.

The stakes are particularly high because the gap between growth leaders and laggards continues to widen. McKinsey’s research shows that sustainable growth outperformers generate seven percentage points more annual total shareholder returns than their peers. In an era where market leadership can shift rapidly, this performance differential can determine long-term viability. Organizations that fail to implement proven growth strategies risk not just stagnation, but obsolescence in increasingly competitive markets.

Core Growth Strategies: Foundation for Sustainable Expansion

Strategy 1: Maximize Core Business Value

The foundation of sustainable growth lies in optimizing existing operations before pursuing new opportunities. McKinsey’s analysis reveals that 80% of successful business growth comes from maximizing the value of core business activities. This finding challenges the common misconception that growth requires dramatic pivots or entirely new business models. Instead, the most reliable path to expansion involves systematically improving current products, services, and customer relationships.

Core business optimization encompasses several critical elements. First, companies must identify and eliminate inefficiencies that constrain growth potential. This includes streamlining operations, improving product quality, and enhancing service delivery. Second, organizations should focus on deepening relationships with existing customers through improved value propositions and expanded service offerings. Third, businesses must invest in capabilities that strengthen their competitive position within current markets.

However, core optimization alone has limitations. While it provides the foundation for growth, companies that rely exclusively on core improvements often reach performance plateaus. McKinsey’s research indicates that the remaining 20% of growth must come from adjacencies and breakthrough innovations. This balance between core optimization and strategic expansion represents a critical success factor for sustained growth.

Strategy 2: Enhance Customer Experience for Competitive Advantage

Customer experience has emerged as perhaps the most powerful driver of business growth in the modern economy. Forrester’s comprehensive study of 98,000 customers across 223 brands demonstrates that customer-obsessed organizations achieve 41% faster revenue growth, 49% faster profit growth, and 51% better customer retention compared to non-customer-obsessed competitors. These performance differentials are substantial enough to determine market leadership over time.

The business impact of customer experience improvements extends beyond immediate revenue gains. Forrester’s research shows that even minor enhancements to customer experience quality can generate tens of millions of dollars in additional revenue by reducing customer churn and increasing share of wallet. Elite brands in Forrester’s index evoke 25 positive emotions for each negative emotion, creating powerful psychological connections that drive loyalty and advocacy.

Despite the clear benefits, most organizations struggle with customer experience execution. Only 3% of companies currently qualify as customer-obsessed, indicating significant opportunity for competitive differentiation. The challenge lies not in understanding the importance of customer experience, but in implementing the organizational changes necessary to deliver consistently superior experiences across all touchpoints.

Strategy 3: Secure Strategic Financing for Growth Initiatives

Access to capital remains a fundamental enabler of business growth, with government data revealing the scale and impact of strategic financing. The Small Business Administration approved $30.8 billion in loans across 67,377 businesses in 2025, with an average loan size of $457,078. This substantial capital deployment demonstrates that successful businesses view financing not as a last resort, but as a strategic tool for accelerating growth initiatives.

| Demographic Segment | Number of Loans | Percentage of Total | Total Amount | Average Loan Size |

|---|---|---|---|---|

| White-owned businesses | 28,758 | 42.7% | $11.7 billion | $407,000 |

| Hispanic-owned businesses | 7,588 | 11.3% | $2.4 billion | $316,000 |

| Asian-owned businesses | 7,291 | 10.8% | $5.2 billion | $713,000 |

| Black/African American-owned | 4,356 | 6.5% | $1.3 billion | $298,000 |

| American Indian/Alaska Native | 510 | 0.8% | $207 million | $406,000 |

| Unanswered | 18,874 | 28.0% | $9.9 billion | $525,000 |

The SBA data reveals important patterns in how businesses utilize growth capital. Hispanic-owned businesses received 11.3% of approved loans totaling $2.4 billion, while Asian-owned businesses captured 10.8% of approvals worth $5.2 billion. This diversity in loan recipients indicates that strategic financing opportunities exist across demographic segments, though access patterns vary significantly.

Strategy 4: Build Innovation Culture and Breakthrough Capabilities

Innovation culture represents one of the three emerging growth strategies identified by McKinsey’s research, distinguishing high-performing organizations from their competitors. Unlike traditional innovation approaches focused on research and development departments, successful companies embed innovation capabilities throughout their organizations, creating systematic processes for identifying and pursuing breakthrough opportunities.

Building innovation culture requires more than encouraging creative thinking; it demands structural changes that support experimentation and risk-taking. This includes establishing dedicated resources for innovation projects, creating safe-to-fail environments where experiments can be conducted without career penalties, and developing metrics that reward learning and adaptation rather than only successful outcomes.

Advanced Growth Strategies: Scaling Beyond Core Operations

| Strategy | Growth Impact | Implementation Timeline | Key Metric | Risk Level |

|---|---|---|---|---|

| Maximize Core Business Value | 80% of total growth | 12-18 months | Revenue per customer | Low |

| Enhance Customer Experience | 41% faster revenue growth | 18-24 months | Customer satisfaction score | Medium |

| Secure Strategic Financing | $457K average investment | 3-6 months | Capital deployment ROI | Medium |

| Build Innovation Culture | Competitive differentiation | 24-36 months | Innovation pipeline value | High |

| Expand into Adjacent Markets | 20% of total growth | 12-24 months | Market share in new segments | Medium-High |

| Leverage Sustainability | 7-point TSR outperformance | 18-36 months | ESG score improvement | Medium |

| Dynamic Resource Allocation | Through-cycle resilience | 6-12 months | Resource utilization efficiency | Medium |

| Strategic Portfolio Reallocation | Focus-driven performance | 6-18 months | Portfolio ROI improvement | High |

Strategy 5: Expand into Adjacent Markets and Value Streams

Adjacent market expansion represents a critical component of sustainable growth, accounting for a significant portion of the 20% of growth that comes from beyond core business optimization. This strategy involves leveraging existing capabilities, customer relationships, or market knowledge to enter related markets or expand value chain participation. Unlike breakthrough innovations that require entirely new capabilities, adjacency strategies build upon established strengths while reducing execution risk.

Strategy 6: Leverage Sustainability as a Growth Accelerant

Sustainability has evolved from a corporate responsibility initiative to a proven growth accelerant, with McKinsey’s research demonstrating that companies integrating environmental, social, and governance (ESG) priorities into their strategies achieve seven percentage points of outperformance in total shareholder returns. This performance advantage reflects both direct business benefits and investor preference for sustainable business models.

Strategy 7: Implement Dynamic Resource Allocation

Dynamic resource allocation represents a fundamental capability that enables companies to maintain growth momentum across economic cycles. McKinsey’s research emphasizes the importance of developing systems that can rapidly redirect capital and talent toward emerging opportunities while divesting from declining areas. This capability becomes particularly critical during periods of economic uncertainty when traditional planning approaches prove inadequate.

Strategy 8: Strategic Portfolio Reallocation and Optimization

Strategic portfolio reallocation, including the concept of “shrinking to grow,” represents an advanced growth strategy that involves divesting underperforming assets to fund higher-potential opportunities. This approach recognizes that growth does not always require expansion; sometimes the most effective path involves focusing resources on the most promising areas while eliminating distractions.

Action Plan: Implementing Growth Strategies Systematically

Successful implementation of these eight growth strategies requires a systematic approach that balances ambition with operational reality. Organizations should begin by conducting comprehensive assessments of their current capabilities and market position to identify the most promising opportunities for improvement. This assessment should evaluate core business performance, customer experience quality, financial resources, innovation capabilities, and strategic options.

The implementation sequence should prioritize strategies that build upon existing strengths while addressing critical weaknesses. Most organizations should begin with core business optimization and customer experience enhancement, as these strategies provide the foundation for more advanced approaches. Once these fundamentals are established, companies can pursue adjacency expansion, sustainability initiatives, and portfolio optimization based on their specific circumstances and market opportunities.

Resource allocation decisions must balance short-term performance requirements with long-term growth investments. McKinsey’s research suggests that companies should maintain growth investments even during challenging periods, as the performance gap between growth-focused and maintenance-focused organizations widens over time. This requires developing financial planning processes that protect strategic investments from short-term budget pressures.

Future Outlook: Navigating Growth in an Uncertain Environment

The business environment for the next decade will likely be characterized by continued volatility, accelerating technological change, and evolving stakeholder expectations. These trends will make the eight proven growth strategies even more critical for business success, while also creating new challenges and opportunities for implementation.

Technological advancement, particularly in artificial intelligence and automation, will reshape competitive dynamics across industries. Companies that successfully integrate these technologies into their growth strategies will gain significant advantages, while those that fail to adapt may find their traditional competitive moats eroded. The key will be balancing technological investment with human-centered approaches that maintain customer relationships and organizational culture.

Key Takeaways

- Focus on fundamentals first: With 80% of growth coming from core business optimization, companies should master existing operations before pursuing dramatic expansion strategies. This foundation enables more advanced approaches while reducing execution risk.

- Customer obsession delivers measurable results: Organizations achieving customer-obsessed status report 41% faster revenue growth and 49% faster profit growth, demonstrating that customer experience investments generate substantial returns when implemented systematically.

- Strategic financing accelerates growth: The $30.8 billion in SBA-approved business loans, averaging $457,078 per recipient, illustrates that successful companies view capital access as a strategic tool rather than a necessity, enabling faster execution of growth initiatives.

- Balanced approach maximizes success: Companies that grow in all directions over ten-year periods have double the chance of outperforming peers, suggesting that diversified growth strategies provide superior risk-adjusted returns compared to single-focus approaches.

References

- McKinsey & Company. “Six strategies for growth outperformance.” May 15, 2024. https://www.mckinsey.com/capabilities/strategy-and-corporate-finance/our-insights/six-strategies-for-growth-outperformance

- Forrester Research. “Forrester Releases 2024 US Customer Experience Index.” June 17, 2024. https://www.forrester.com/press-newsroom/forrester-2024-us-customer-experience-index/

- U.S. Small Business Administration. “SBA Office Of Capital Access – 7(a) & 504 Summary Report.” Data as of August 9, 2025. https://data.sba.gov/dataset/office-of-capital-access