Opening Summary

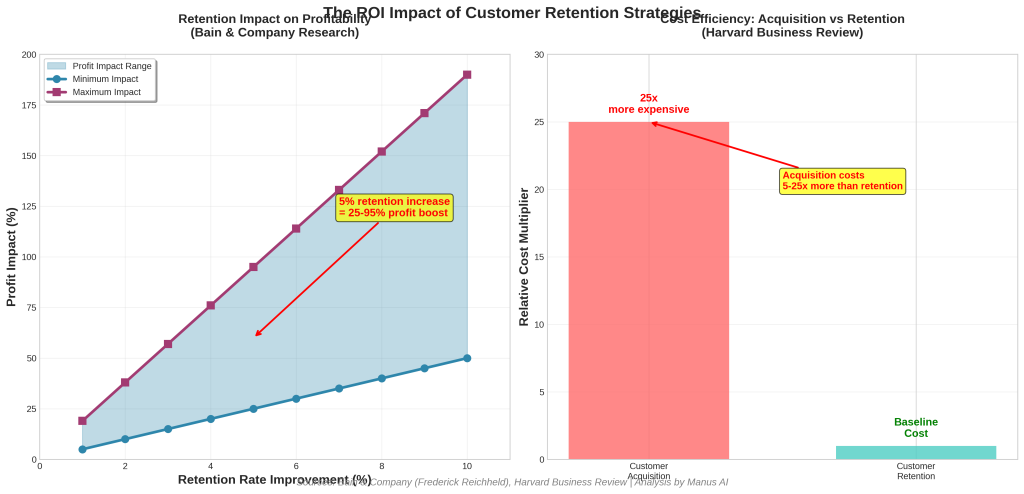

In the increasingly competitive B2B SaaS landscape, a single statistic reveals the transformative power of customer retention: increasing retention rates by just 5% can boost profits by 25% to 95%, according to research by Frederick Reichheld of Bain & Company [1]. This dramatic impact stems from a fundamental economic reality—acquiring new customers costs between 5 to 25 times more than retaining existing ones [2]. As customer acquisition costs rose 14% in 2024 alone [3], forward-thinking SaaS companies are shifting their focus from growth-at-all-costs to sustainable, retention-driven expansion.

The stakes have never been higher. With median Net Revenue Retention rates compressed to 101% in 2026 [4] and B2B customer retention rates averaging 76-81% across industries [5], companies that master retention strategies gain a decisive competitive advantage. This comprehensive analysis examines the data-driven approaches, proven frameworks, and emerging technologies that enable B2B SaaS companies to transform customer retention from a defensive necessity into a primary growth engine.

Why Customer Retention Matters More Than Ever in 2026

The B2B SaaS industry stands at a critical inflection point. The era of venture capital-fueled, growth-at-any-cost expansion has given way to a new reality where sustainable profitability and efficient capital deployment determine long-term success. This shift has elevated customer retention from a secondary concern to a strategic imperative that directly impacts valuation, investor confidence, and market positioning.

Economic pressures have fundamentally altered the SaaS growth equation. McKinsey’s research reveals that existing customers now account for between one-third to one-half of total revenue growth, even at early-stage startups [6]. This represents a significant departure from traditional acquisition-focused models and reflects the maturation of the SaaS market.

The financial mathematics of retention create compelling advantages that extend far beyond simple cost savings. Revenue expansion from existing customers requires only a fraction of the resources needed for new customer acquisition [7]. This efficiency gain becomes particularly pronounced as companies scale, where the marginal cost of serving additional users within existing accounts approaches zero while the lifetime value continues to compound.

The Economics of Customer Retention: Quantifying the Impact

The financial case for prioritizing customer retention rests on three fundamental economic principles: cost efficiency, revenue predictability, and compound growth effects. Understanding these dynamics enables SaaS leaders to make data-driven decisions about resource allocation and strategic priorities.

Cost Efficiency: The Acquisition vs. Retention Equation

Harvard Business Review’s comprehensive analysis demonstrates that customer acquisition costs consistently outweigh retention investments by a factor of 5 to 25 [8]. This disparity reflects the substantial resources required to generate awareness, nurture prospects, and convert them into paying customers. Acquisition efforts must overcome market noise, competitive alternatives, and buyer inertia, while retention strategies build upon existing relationships and demonstrated value.

McKinsey’s research on Customer Success 2.0 reveals that top-quartile SaaS vendors achieved superior revenue performance by investing more heavily in customer success initiatives specifically aimed at churn reduction [9]. These companies recognized that retention investments generate immediate returns through reduced churn while simultaneously creating conditions for expansion revenue through deeper product adoption and increased user satisfaction.

Industry Benchmarks and Performance Standards

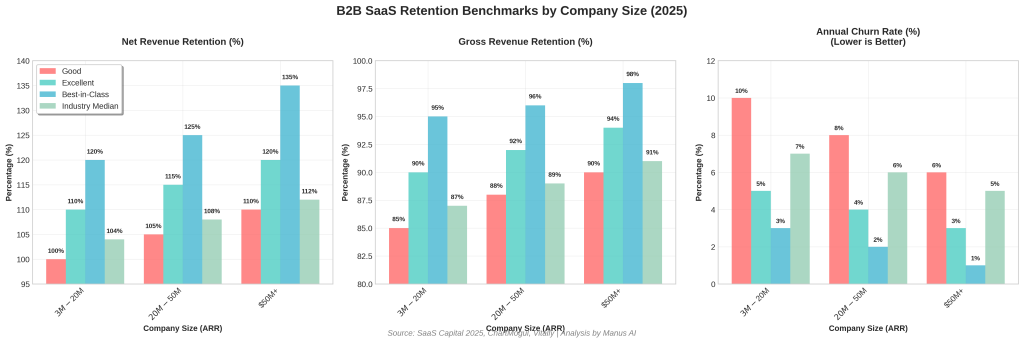

Net Revenue Retention (NRR) has emerged as the critical metric for measuring combined retention and expansion performance. Industry benchmarks reveal significant variation based on company size and maturity:

| Company Size (ARR) | Median NRR | 90th Percentile NRR | Industry Benchmark |

|---|---|---|---|

| $3M – $20M | 104% | 115%+ | Good: >100% |

| $20M – $50M | 108% | 125%+ | Excellent: >110% |

| $50M+ | 112% | 135%+ | Best-in-class: >120% |

Source: SaaS Capital 2026 Benchmarks [12]

Core Retention Strategies: The Customer Success 2.0 Framework

The evolution of customer retention strategies reflects the broader maturation of the SaaS industry. Early-stage companies often rely on reactive approaches, responding to churn signals after customers have already decided to leave. However, industry leaders have developed sophisticated proactive frameworks that identify and address retention risks before they materialize into actual churn.

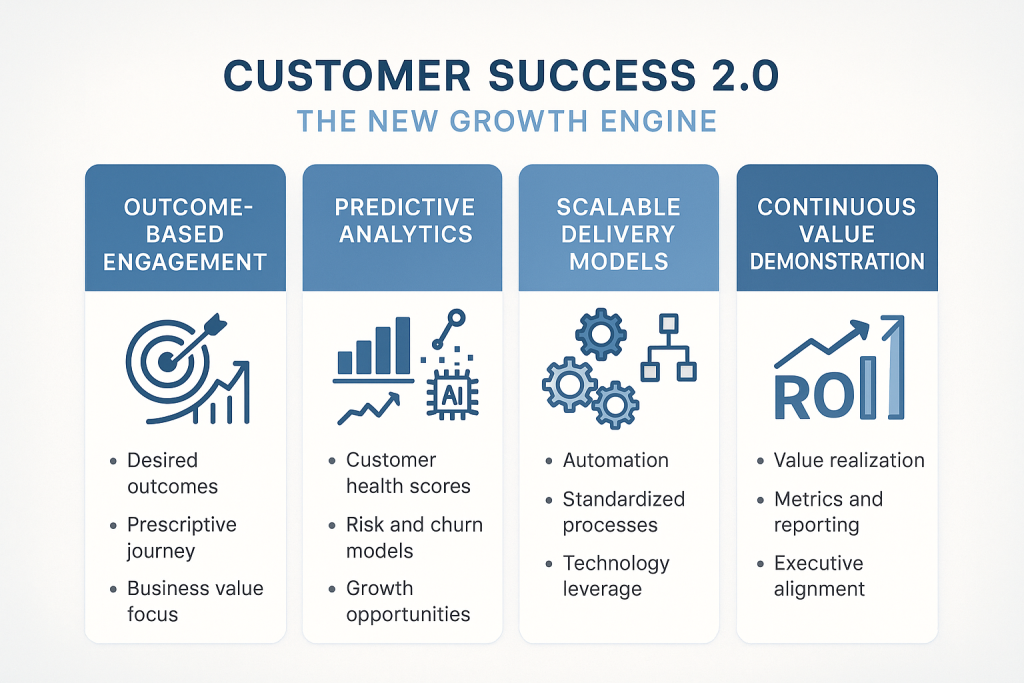

The Customer Success 2.0 Model

McKinsey’s Customer Success 2.0 model represents a fundamental shift from traditional account management to value-driven customer lifecycle management [15]. This approach recognizes that customer success extends beyond simple satisfaction metrics to encompass measurable business outcomes that align with customer strategic objectives.

The framework operates on four core principles: outcome-based engagement, predictive analytics, scalable delivery models, and continuous value demonstration. Unlike traditional customer success approaches that focus primarily on product adoption and usage metrics, Customer Success 2.0 emphasizes the business results that customers achieve through the SaaS platform.

Data-Driven Churn Prediction and Prevention

The most sophisticated retention strategies leverage advanced analytics to predict and prevent churn before customers exhibit obvious warning signs. This approach requires comprehensive data collection across multiple touchpoints, including product usage, support interactions, billing history, and external factors such as industry trends or economic conditions.

Effective churn prediction models typically incorporate both behavioral and contextual indicators. Behavioral indicators include declining usage patterns, reduced feature adoption, increased support ticket volume, and delayed payment patterns. Contextual indicators encompass factors such as organizational changes, budget cycles, competitive pressures, and industry-specific challenges that may influence customer retention decisions.

Case Study: HubSpot’s Retention Excellence

HubSpot’s approach to customer retention exemplifies the practical application of data-driven retention strategies in a high-growth B2B SaaS environment. When the company’s churn rate increased during the 2008 economic downturn, leadership invested heavily in understanding the underlying drivers of customer attrition and developing systematic approaches to address them [16].

The company’s analysis revealed that churn correlated strongly with low product adoption rather than external economic factors. Customers who failed to achieve meaningful results within their first 90 days were significantly more likely to cancel their subscriptions, regardless of their initial enthusiasm or budget availability. This insight shifted HubSpot’s focus from reactive retention efforts to proactive onboarding and adoption programs.

HubSpot developed a comprehensive customer health scoring system that tracked multiple dimensions of customer engagement, including feature usage, content consumption, and goal achievement. The system automatically identified customers at risk of churn and triggered personalized intervention workflows designed to address specific adoption barriers.

Implementation Framework: A Strategic Action Plan

Successful retention strategy implementation requires systematic approaches that balance quick wins with long-term capability development. The most effective implementations follow structured frameworks that address technology, processes, and organizational capabilities in coordinated phases.

Phase 1: Foundation Building (Months 1-3)

The initial phase focuses on establishing basic measurement capabilities and identifying immediate retention opportunities. Companies should begin by implementing comprehensive data collection across all customer touchpoints, including product usage, support interactions, and billing activities. This data foundation enables accurate baseline measurement and identifies the most critical retention risks.

Customer segmentation represents a critical early priority that enables targeted retention approaches. Companies should develop segmentation frameworks based on customer value, churn risk, and expansion potential. These segments inform resource allocation decisions and enable customized retention strategies that reflect different customer needs and characteristics.

Phase 2: Analytics and Prediction (Months 4-8)

The second phase introduces predictive analytics capabilities that enable proactive retention interventions. Companies should implement churn prediction models that combine behavioral and contextual indicators to identify at-risk customers before obvious warning signs appear.

Customer health scoring systems provide scalable approaches to monitoring retention risks across large customer bases. These systems should incorporate multiple data sources and provide clear, actionable insights that enable customer success teams to prioritize their efforts effectively.

Phase 3: Optimization and Expansion (Months 9-12)

The final phase focuses on optimizing retention strategies based on performance data and expanding successful approaches across the entire customer base. Companies should conduct comprehensive analysis of retention program effectiveness and refine their approaches based on empirical results.

Advanced segmentation and personalization capabilities enable more sophisticated retention approaches that reflect individual customer characteristics and preferences. These capabilities often generate significant improvements in retention outcomes while reducing the resources required for customer success activities.

Measuring Success: Key Metrics and ROI Frameworks

Effective retention strategies require comprehensive measurement frameworks that track both leading and lagging indicators of customer success. The most sophisticated companies develop multi-dimensional measurement approaches that provide insights into customer health, retention effectiveness, and business impact across different time horizons and customer segments.

| Metric | Good | Excellent | Best-in-Class | Industry Median |

|---|---|---|---|---|

| Net Revenue Retention | >100% | >110% | >120% | 104% |

| Gross Revenue Retention | >85% | >90% | >95% | 87% |

| Annual Churn Rate | <10% | <5% | <3% | 7% |

| Customer Success ROI | >50% | >75% | >100% | 65% |

| Time to Value | <90 days | <60 days | <30 days | 75 days |

Sources: SaaS Capital, ChartMogul, Vitally [19]

Research indicates that well-designed customer success programs can generate 91% ROI over a three-year period [18]. This return stems from multiple sources, including direct churn reduction, expansion revenue generation, reduced acquisition costs through referrals, and improved operational efficiency through better customer segmentation and targeting.

Future Outlook: Emerging Trends and Strategic Considerations

The customer retention landscape continues to evolve rapidly as new technologies, changing customer expectations, and economic pressures reshape the B2B SaaS industry. Companies that anticipate and adapt to these trends will gain competitive advantages, while those that rely on static approaches risk falling behind more agile competitors.

Artificial Intelligence and Machine Learning Integration

Artificial intelligence and machine learning technologies are transforming retention strategies by enabling more sophisticated prediction, personalization, and automation capabilities. Natural language processing enables automated analysis of customer communications to identify sentiment trends and satisfaction indicators that traditional metrics might miss.

Predictive analytics capabilities continue to improve as machine learning algorithms become more sophisticated and training datasets grow larger. Future retention platforms will likely incorporate real-time prediction updates that reflect changing customer circumstances and market conditions.

Economic Uncertainty and Budget Pressures

Economic uncertainty and budget pressures continue to influence customer retention dynamics. Companies must develop retention strategies that demonstrate clear value and ROI while remaining sensitive to customer financial constraints. This environment favors retention approaches that focus on business outcomes rather than feature adoption or usage metrics.

The increasing scrutiny of technology spending requires retention teams to develop sophisticated value demonstration capabilities that connect platform usage to measurable business results. Companies that can clearly articulate and quantify their value proposition will maintain competitive advantages during economic downturns.

Key Takeaways

The data overwhelmingly supports prioritizing customer retention as a primary growth strategy for B2B SaaS companies. Four critical insights emerge from this analysis:

- Retention delivers exceptional ROI: Increasing retention rates by just 5% can boost profits by 25-95%, while customer acquisition costs 5-25 times more than retention. Well-designed customer success programs generate 91% ROI over three years, making retention one of the highest-impact investments available to SaaS companies.

- Proactive approaches outperform reactive strategies: Companies that implement predictive analytics and proactive intervention workflows achieve superior retention outcomes compared to those that rely on reactive churn management. The most successful companies identify and address retention risks before customers exhibit obvious warning signs.

- Technology enables scalable retention: Modern customer success platforms and predictive analytics tools enable companies to deliver personalized retention experiences at scale. However, successful implementation requires careful attention to data quality, integration challenges, and organizational change management.

- Measurement drives improvement: Comprehensive measurement frameworks that track both leading and lagging indicators enable continuous optimization of retention strategies. Companies should benchmark their performance against industry standards while developing segment-specific metrics that reflect their unique customer characteristics and market dynamics.

Frequently Asked Questions

What is the difference between Net Revenue Retention (NRR) and Gross Revenue Retention (GRR)?

Net Revenue Retention (NRR) measures the percentage of revenue retained from existing customers over a specific period, including the positive impact of expansions and upsells. NRR values above 100% indicate that expansion revenue from existing customers exceeds revenue lost to churn and downgrades. Gross Revenue Retention (GRR), conversely, measures revenue retention excluding expansions, providing a pure measure of retention effectiveness that isolates churn and downgrade impacts from growth activities. Best-in-class B2B SaaS companies typically achieve GRR above 90% and NRR above 110%.

How long does it typically take to see ROI from customer retention investments?

Most companies begin seeing measurable improvements in retention metrics within 3-6 months of implementing systematic customer success programs. However, the full ROI impact typically becomes apparent over 12-18 months as retention improvements compound and expansion opportunities materialize. Research indicates that well-designed customer success programs generate 91% ROI over a three-year period, with the most significant returns occurring in years two and three as customer relationships mature and expand.

What are the most common mistakes companies make when implementing retention strategies?

The four most common mistakes include: 1) Taking churn as inevitable rather than preventable, leading to reactive rather than proactive approaches; 2) Focusing on metrics rather than underlying customer behaviors and needs; 3) Believing there’s a universal “good” churn rate without considering business model differences; and 4) Addressing retention problems when the real issue is poor customer acquisition that attracts the wrong customer segments. Companies should focus on acquiring the right customers and then implementing proactive retention strategies based on predictive analytics.

How do economic downturns affect B2B SaaS customer retention strategies?

Economic uncertainty typically increases customer scrutiny of technology spending, making value demonstration more critical for retention success. During downturns, companies must shift from feature-focused to outcome-focused retention strategies that clearly connect platform usage to measurable business results. Successful retention strategies during economic stress emphasize cost savings, efficiency gains, and revenue protection rather than growth and expansion. Companies that can quantify their value proposition and demonstrate clear ROI maintain competitive advantages during challenging economic periods.

What role does artificial intelligence play in modern customer retention strategies?

AI and machine learning technologies enhance retention strategies through improved churn prediction, automated customer health scoring, and personalized intervention recommendations. Natural language processing enables automated analysis of customer communications to identify sentiment trends and satisfaction indicators. Predictive analytics algorithms can process hundreds of variables simultaneously to identify subtle churn risk indicators that human analysis might miss. However, successful AI implementation requires high-quality data, technical expertise, and careful balance between automation and human relationship management.

How should small SaaS companies approach customer retention differently than enterprise companies?

Small SaaS companies typically need to focus on scalable, technology-driven retention approaches due to resource constraints, while enterprise companies can afford more high-touch, personalized customer success programs. Small companies should prioritize automated customer health scoring, self-service onboarding resources, and community-driven support models. Enterprise companies can invest in dedicated customer success managers, custom implementation services, and executive relationship programs. However, both segments benefit from data-driven approaches to churn prediction and proactive intervention strategies tailored to their customer characteristics and business models.

References

- Reichheld, F. (Bain & Company). “The Value of Customer Retention.” Referenced in: Lineal CPA. “SaaS Customer Lifetime Value: Top 3 Vital Insights 2025.” https://www.linealcpa.com/blog/saas-customer-lifetime-value

- Gallo, A. (2014). “The Value of Keeping the Right Customers.” Harvard Business Review. https://hbr.org/2014/10/the-value-of-keeping-the-right-customers

- Pavilion. (2025). “2025 B2B SaaS Benchmarks: CAC, NRR & Growth Rate Metrics.” https://www.joinpavilion.com/resource/2024-b2b-saas-performance-benchmarks

- SaaS Capital. (2025). “2025 Private B2B SaaS Company Growth Rate Benchmarks.” https://www.saas-capital.com/research/private-saas-company-growth-rate-benchmarks/

- Forrester Research. (2021). “Forrester’s Planning Assumptions Reveal Key Trends.” https://investor.forrester.com/news-releases/news-release-details/forresters-planning-assumptions-reveal-key-trends-will-impact

- Atkins, C., Gupta, S., & Roche, P. (2018). “Introducing customer success 2.0: The new growth engine.” McKinsey & Company. McKinsey Customer Success 2.0 Report

- McKinsey & Company. (2018). “Introducing customer success 2.0: The new growth engine.”

- Harvard Business Review. (2014). “The Value of Keeping the Right Customers.”

- McKinsey & Company. (2018). “Introducing customer success 2.0: The new growth engine.”

- SaaS Capital. (2025). “2025 Benchmarking Metrics for Bootstrapped SaaS Companies.” https://www.saas-capital.com/blog-posts/benchmarking-metrics-for-bootstrapped-saas-companies/

- McKinsey & Company. (2018). “Introducing customer success 2.0: The new growth engine.”

- Harvard Business Review. (2014). “The Value of Keeping the Right Customers.” (HubSpot case study referenced)

- Vitally. “16 Customer Success Statistics That CS Teams Need to Know.” https://www.vitally.io/post/customer-success-statistics

- Multiple sources: SaaS Capital (2025), ChartMogul (2024), Vitally (2024)