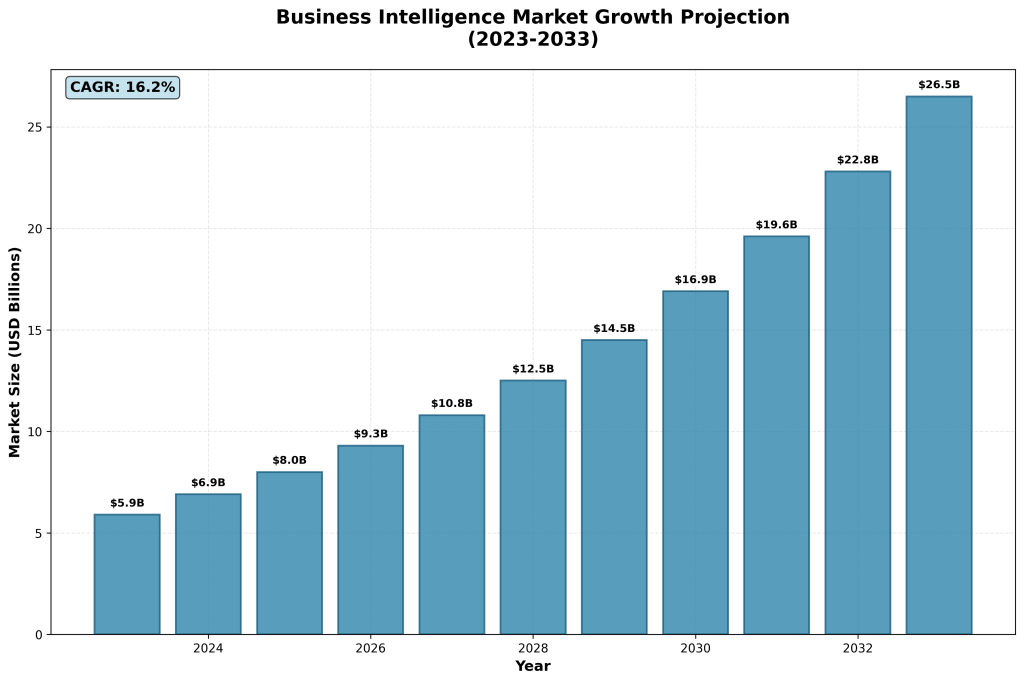

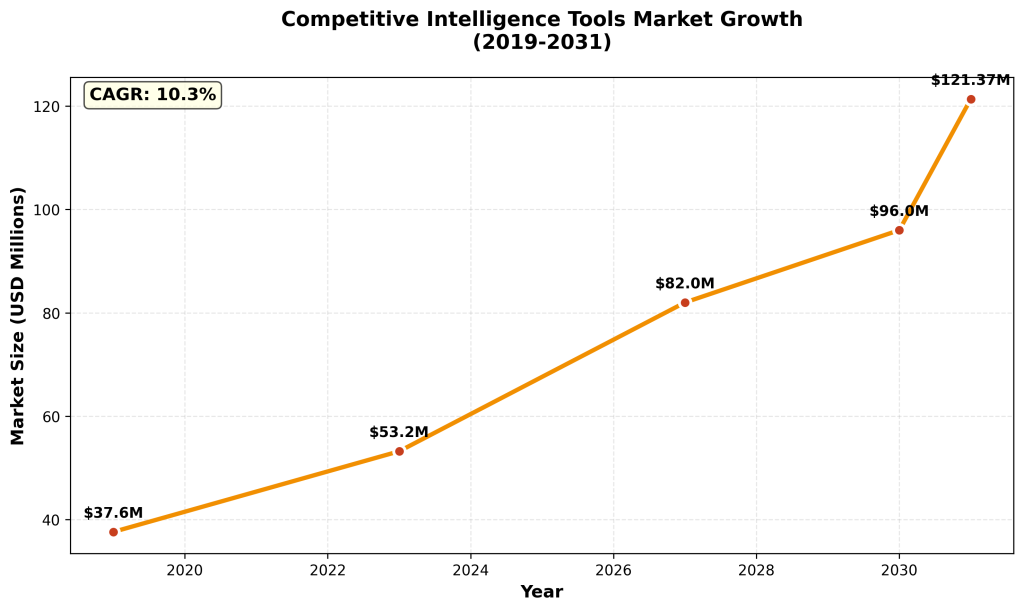

In today’s data-driven business landscape, organizations face an unprecedented challenge: how to effectively harness information for competitive advantage. Two critical disciplines have emerged as essential components of modern business strategy—Business Intelligence (BI) and Competitive Intelligence (CI). While these terms are often used interchangeably, they represent fundamentally different approaches to data analysis and strategic decision-making. The global Business Intelligence market is projected to reach $26.5 billion by 2033, growing at a remarkable 16.2% CAGR, while the Competitive Intelligence tools market is expected to expand to $121.37 million by 2031 with a 10.3% CAGR.

Defining Business Intelligence: The Internal Focus

Business Intelligence represents a comprehensive approach to collecting, analyzing, and disseminating internal organizational data to drive operational efficiency and strategic decision-making. According to academic research from the University of Missouri, BI is defined as “the process of collecting, analyzing and disseminating data to provide insights that contribute to an institution’s competitive edge” through internal data optimization.

The core strength of BI lies in its ability to transform raw internal data into meaningful information that empowers administrators and stakeholders to make informed decisions in real-time. This centralized data hub enhances operational efficiency, enables predictive analytics, and streamlines reporting processes. Research from the University of Malta identifies that BI systems offer “transformative potential, promising to elevate organizations by consolidating and processing voluminous institutional data.”

However, BI implementation faces significant challenges. Academic studies reveal that initial cost and resource demands for system integration can be substantial, requiring meticulous budgeting and planning. Additionally, the human factor introduces complexities as faculty and staff may resist change, mandating comprehensive training and support to maximize BI system utility.

Understanding Competitive Intelligence: The External Perspective

Competitive Intelligence takes a fundamentally different approach, focusing on external market conditions, competitor activities, and industry trends. The University of Missouri defines CI as “the process of collecting, analyzing and disseminating data to provide insights that contribute to an institution’s competitive edge” through external market analysis and competitor monitoring.

CI encompasses a systematic three-step process: Collect data from external sources including competitor databases, market research, and industry publications; Analyze this information using analytical tools to identify patterns and opportunities; and Interpret findings to provide actionable insights for strategic planning. The typical turnaround time for comprehensive CI analysis ranges from 10-15 business days, reflecting the thorough nature of external market research.

The CI market demonstrates robust growth potential, with North America dominating 43.61% of the global market share in 2019. This dominance stems from the growing demand for data analytics tools and the presence of major enterprises and key players such as Crayon Group, Alexa Internet, Inc., and ArchIntel in the United States.

Market Analysis and Growth Projections

The Business Intelligence market demonstrates exceptional growth momentum, with multiple authoritative projections confirming its expanding influence. Market research indicates the global BI and analytics market will reach $55.48 billion by 2026, growing at a CAGR of 10.1% from 2021 to 2026. Alternative projections suggest even more aggressive growth, with some estimates reaching $84.6 billion by 2026 at a CAGR of 14.7%.

The Competitive Intelligence tools market, while smaller in absolute terms, shows consistent growth patterns. Starting from $37.6 million in 2019, the market is projected to reach $82.0 million by 2027 and further expand to $121.37 million by 2031. This growth trajectory reflects increasing recognition of CI’s strategic value in competitive positioning.

Adoption Patterns and Business Impact

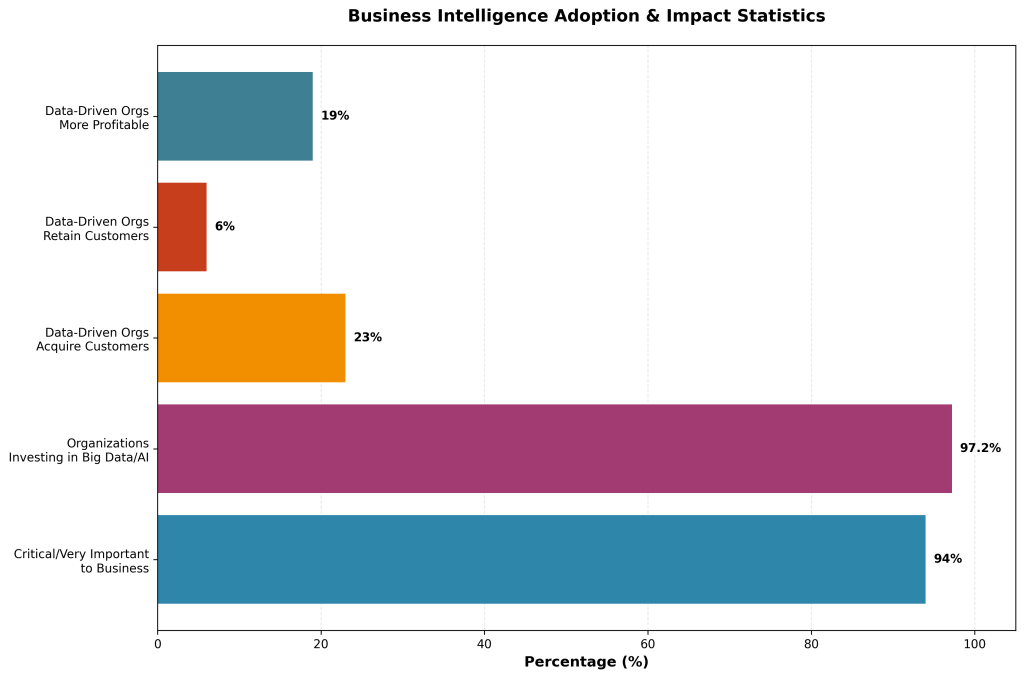

Adoption statistics reveal the critical importance organizations place on intelligence systems. Research from Dresner Advisory Services indicates that 94% of organizations rate business intelligence and analytics as either critical or very important to their business success. Furthermore, 97.2% of executives report their organizations are investing in or planning to invest in big data and AI to drive decision-making, according to NewVantage Partners.

The business impact of data-driven approaches is substantial. McKinsey research demonstrates that data-driven organizations are 23 times more likely to acquire customers, 6 times more likely to retain customers, and 19 times more likely to be profitable compared to their peers. These statistics underscore the competitive advantage that effective intelligence systems can provide.

Key Differences and Strategic Applications

| Aspect | Business Intelligence | Competitive Intelligence |

|---|---|---|

| Primary Focus | Internal data optimization and operational efficiency | External market analysis and competitor monitoring |

| Data Sources | Internal databases, ERP systems, CRM platforms | Market research, competitor websites, industry reports |

| Time Horizon | Real-time to short-term operational decisions | Medium to long-term strategic planning |

| Market Size (2031) | $26.5 billion (projected 2033) | $121.37 million |

| Growth Rate | 16.2% CAGR (2024-2033) | 10.3% CAGR (2019-2031) |

| Key Deliverables | Dashboards, performance reports, predictive models | Competitor analysis, market intelligence reports |

Implementation Challenges and Limitations

Both BI and CI systems face significant implementation challenges that organizations must carefully consider. Academic research from the University of Malta identifies several critical limitations for BI systems, including substantial initial costs, human factor complexities involving staff resistance to change, and data quality challenges due to divergent collection methods across departments.

For Competitive Intelligence, challenges include the complexity of gathering reliable external data, the time-intensive nature of comprehensive market analysis, and the need for specialized expertise in competitor analysis. The 10-15 business day turnaround time for CI analysis reflects these inherent complexities in external data gathering and verification.

Strategic Implementation Framework

Organizations seeking to implement effective intelligence systems should adopt a phased approach that addresses both internal optimization and external market awareness. The framework should begin with establishing clear objectives for data collection and analysis, followed by identifying appropriate data sources and analytical tools.

For Business Intelligence implementation, organizations should prioritize data quality and consistency, invest in comprehensive training programs to address human factor challenges, and establish clear governance frameworks for data management. The University of Malta research emphasizes the importance of “meticulous budgeting and planning” to address substantial initial costs.

Competitive Intelligence implementation requires developing systematic processes for external data collection, establishing relationships with reliable market research sources, and creating analytical frameworks for competitor monitoring. Organizations should also consider the ethical and legal implications of competitive data gathering.

Future Outlook and Emerging Trends

The future of both BI and CI is increasingly intertwined with artificial intelligence and machine learning technologies. Research indicates that 83% of early AI adopters have achieved substantial (30% or more) or moderate (15% to 30%) economic benefits from their AI initiatives, according to Deloitte studies.

The Asia Pacific region is expected to show rapid growth in CI adoption, particularly in expanding economies such as China, India, and Southeast Asia. China’s leadership in manufacturing, healthcare, retail, and advanced technologies positions it to lead regional market growth. The increasing social media presence in countries like India, China, and Japan drives demand for competitive intelligence tools in these regions.

Data volume growth presents both opportunities and challenges for intelligence systems. The total volume of data worldwide is estimated to reach 175 zettabytes by 2025 (where 1 zettabyte equals 1 trillion gigabytes), according to IDC research. This exponential growth necessitates more sophisticated analytical tools and processing capabilities.

Key Takeaways

- Complementary Approaches: BI and CI serve different but complementary strategic purposes, with BI focusing on internal optimization and CI on external market intelligence.

- Market Growth: The BI market demonstrates significantly larger scale ($26.5B projected) compared to CI tools ($121.37M projected), reflecting broader organizational adoption of internal analytics.

- Implementation Challenges: Both systems require substantial initial investment, comprehensive training programs, and ongoing data quality management to achieve optimal results.

- Strategic Value: Organizations implementing data-driven approaches achieve measurable competitive advantages, including 23x higher customer acquisition rates and 19x greater profitability.

References

- University of Missouri Research Analytics. “Competitive Intelligence.” https://research.missouri.edu/research-analytics/competitive-intelligence

- Market.us Scoop. “Business Intelligence Statistics and Facts (2025).” https://scoop.market.us/business-intelligence-statistics/

- Fortune Business Insights. “Competitive Intelligence Tools Market Size & Share.” https://www.fortunebusinessinsights.com/competitive-intelligence-tools-market-104522

- Farrugia, Carmen (2023). “The strengths and limitations of implementing a business intelligence system in a higher education setting.” University of Malta. https://www.um.edu.mt/library/oar/handle/123456789/119259

- Dresner Advisory Services. Business Intelligence Market Research.

- McKinsey & Company. Data-driven organization research.

- NewVantage Partners. Big Data and AI Executive Survey.

- Deloitte. AI adoption and economic benefits study.

- IDC. Global data volume projections.