The medical device industry stands at a critical juncture where traditional marketing approaches must evolve to meet stringent regulatory requirements while embracing digital transformation. With the U.S. representing over 40% of the global medtech market and generating $381 billion in annual economic output, effective marketing strategies have become essential for companies seeking to navigate complex FDA pathways and reach healthcare professionals in an increasingly digital landscape.

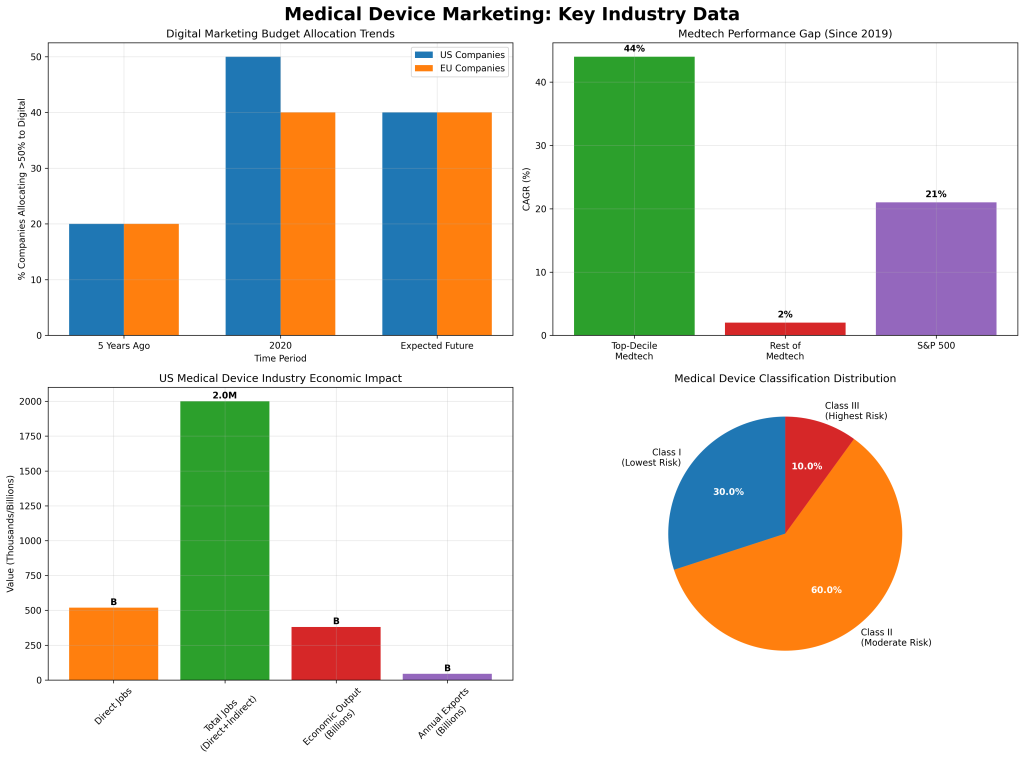

Recent data from McKinsey reveals that 90% of medtech companies report at least 10% improvement in digital marketing success, while top-performing companies achieve 44% compound annual growth rates compared to just 2% for industry laggards. This performance gap underscores the critical importance of developing comprehensive marketing plans that balance regulatory compliance with innovative engagement strategies.

The Regulatory Foundation: Understanding FDA Marketing Pathways

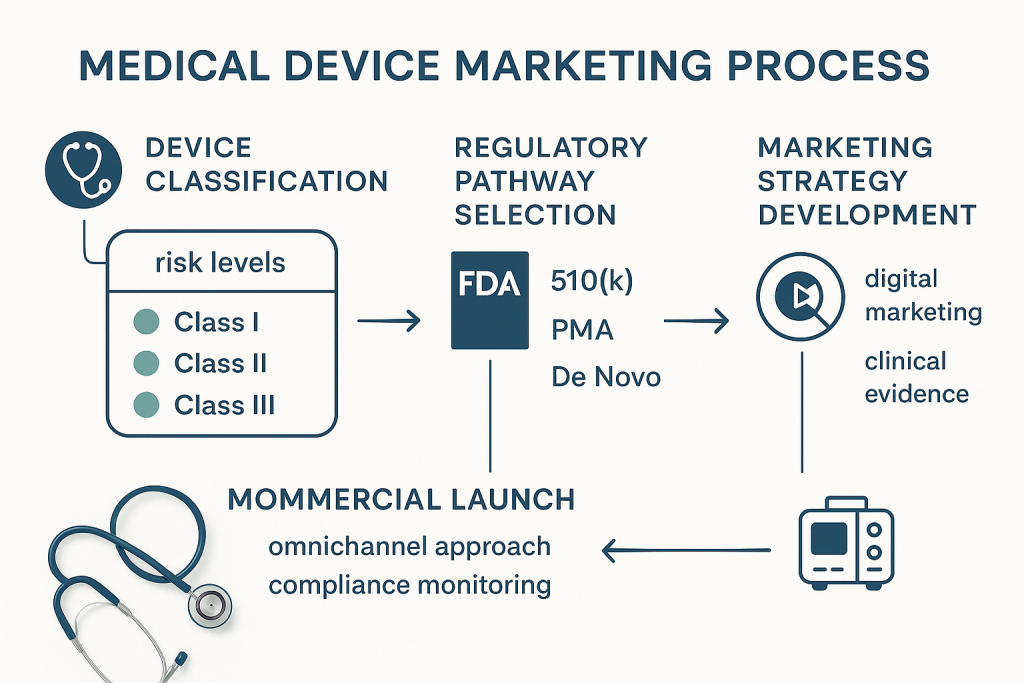

Medical device marketing begins with understanding the FDA’s risk-based classification system, which directly impacts both regulatory requirements and marketing strategies. The FDA categorizes devices into three classes based on risk levels, with each requiring different premarket pathways and marketing considerations.

Device Classification and Marketing Implications

| Device Class | Risk Level | Regulatory Pathway | Marketing Considerations |

|---|---|---|---|

| Class I | Lowest Risk | 510(k) or Exempt | Simplified marketing claims, general controls compliance |

| Class II | Moderate Risk | 510(k) or Exempt | Substantial equivalence demonstration, special controls |

| Class III | Highest Risk | PMA Required | Extensive clinical evidence, safety and effectiveness data |

The FDA’s four-step marketing process provides a structured framework that companies must follow. First, device classification determines applicable regulatory controls and submission requirements. Second, companies must select and prepare the appropriate premarket submission, whether 510(k), PMA, De Novo, or HDE. Third, the submission undergoes FDA review with potential for interactive feedback. Finally, companies must comply with ongoing regulatory controls including establishment registration and device listing.

This regulatory foundation significantly impacts marketing strategies, as promotional materials must align with FDA-cleared or approved indications. Companies cannot market devices for off-label uses, and all promotional claims must be substantiated by clinical evidence included in regulatory submissions. The complexity of this environment requires marketing teams to work closely with regulatory affairs to ensure compliance while developing compelling value propositions.

Industry Performance and Market Dynamics

The medical device industry demonstrates significant performance disparities that directly correlate with marketing effectiveness. According to McKinsey’s 2024 analysis, top-decile medtech companies have achieved remarkable growth rates of 44% CAGR since 2019, substantially outpacing both industry peers at 2% CAGR and the broader S&P 500 at 21% CAGR.

This performance gap reflects several critical factors that successful companies have mastered. High-performing organizations demonstrate above-average industry growth, maintain relentless focus on quality, develop rich innovation pipelines, achieve rising profit margins, and sustain steady free cash flow levels. Underneath these financial metrics, leading companies have implemented similar strategic approaches to value creation.

Economic Impact and Market Scale

The U.S. medical device industry’s economic footprint provides context for marketing investment decisions. AdvaMed data shows the industry directly employs 519,000 Americans with total employment reaching nearly 2 million when including indirect effects. The sector generates $381 billion in annual economic output and maintains a positive trade balance with over $44 billion in annual exports.

These economic multiplier effects demonstrate the industry’s significance beyond individual company performance. Every $1 billion in medtech revenue generates an additional $1.69 billion in national economic output, nearly 13,000 jobs, and $778 million in personal income. This broader economic impact provides compelling narratives for marketing communications, particularly when engaging with healthcare systems and policymakers.

However, the industry faces challenges that marketing strategies must address. R&D spending as a percentage of sales has grown by 300 basis points since 2008, while the bar for new product adoption has risen significantly. Healthcare professionals increasingly expect meaningful innovation backed by clinical evidence rather than incremental improvements, requiring more sophisticated marketing approaches.

Digital Transformation in Medtech Marketing

The COVID-19 pandemic accelerated digital transformation across the medical device industry, fundamentally changing how companies engage with healthcare professionals. McKinsey’s 2021 survey of 100 medtech companies revealed dramatic shifts in digital marketing adoption and effectiveness.

Five years ago, 65% of medtech companies allocated no more than 20% of their marketing budgets to digital channels. By 2020, this landscape had transformed dramatically, with 84% of U.S. companies and 74% of EU companies shifting more resources to digital marketing. Approximately 20% of companies now dedicate at least 50% of their marketing budgets to digital initiatives, with expectations that the average will reach 40% industry-wide.

Digital Marketing Applications and Success Metrics

The shift to digital marketing has concentrated around four key applications that demonstrate measurable impact. Product launches have largely moved online, with 80% of companies using email and social media campaigns and 65% leveraging online conferences for new product introductions. This transition became necessary as traditional trade shows and conferences were canceled during the pandemic.

Lead generation represents another critical application, with 45% of companies identifying email campaigns as the most effective digital channel for generating new opportunities during product launches. Social media campaigns follow closely at 40% effectiveness, while personalized messaging using customer personas has proven particularly valuable for post-sales communication.

Next-best-action analytics have emerged as a sophisticated application, with 74% of respondents indicating strong need for better coordination between marketing and sales channels. Advanced implementations incorporate machine learning to build integrated data pipelines and dashboards that help sales representatives segment and prioritize accounts while enabling customer-centric engagement approaches.

Omnichannel campaigns represent the most comprehensive application, with 55% of companies running multichannel campaigns that coordinate digital initiatives with traditional channels including inside sales and face-to-face representative visits. U.S. companies demonstrate higher adoption of cross-division campaigns at 30% compared to 20% in the EU, often combining multichannel and cross-division approaches.

Measurable Success Stories and ROI

Real-world implementations demonstrate the potential of digital marketing when properly executed. One global medtech company optimized paid search, launched refined social media advertising campaigns, and implemented A/B testing for weekly landing page updates, resulting in a five-fold increase in qualified leads within four months. A smaller company deployed agile marketing and digital channels to increase message testing from one or two new messages every two to three months to over 50 messages in three months, achieving a 20-fold increase in average lead volumes for prioritized product families.

Perhaps most dramatically, a global medical device company that purchased licenses for a social media marketing platform saw digital connections among 100 staff members grow from 1,500 to 70,000 other users in just six months. These success stories illustrate the scalability and rapid impact potential of well-designed digital marketing initiatives.

Strategic Action Plan for Medical Device Marketing

Developing effective marketing plans for medical devices requires a systematic approach that integrates regulatory compliance with digital innovation. Companies should begin by conducting comprehensive device classification analysis to understand applicable regulatory pathways and marketing constraints. This foundation enables informed decisions about resource allocation and messaging strategies.

Phase 1: Regulatory and Market Assessment

The initial phase involves thorough analysis of device classification, competitive landscape, and target market characteristics. Companies must identify the appropriate FDA pathway (510(k), PMA, De Novo, or HDE) and understand how regulatory requirements will impact marketing claims and promotional activities. Simultaneously, market research should identify key healthcare professional segments, their information preferences, and decision-making processes.

Competitive analysis becomes particularly important given the performance gaps observed in the industry. Companies should benchmark against top-performing organizations to identify best practices in innovation productivity, portfolio management, and commercial capabilities. This analysis should inform strategic decisions about market positioning and differentiation strategies.

Phase 2: Digital Infrastructure Development

Building digital marketing capabilities requires significant infrastructure investment and organizational change management. Companies should prioritize customer relationship management systems that integrate with marketing automation platforms, enabling personalized communication and lead nurturing. Analytics capabilities must support next-best-action recommendations and omnichannel campaign coordination.

Content management systems should accommodate regulatory review processes while enabling rapid iteration and testing. Social media management platforms, search engine optimization tools, and digital advertising capabilities form the foundation for effective digital engagement. However, technology implementation alone is insufficient without proper change management to ensure adoption across sales, marketing, and customer service functions.

Phase 3: Omnichannel Campaign Implementation

Successful medical device marketing requires coordinated campaigns that leverage both digital and traditional channels. Email marketing should be personalized based on healthcare professional specialties, practice settings, and previous engagement history. Social media campaigns must balance educational content with promotional messaging while maintaining regulatory compliance.

Search engine marketing becomes particularly important for reaching healthcare professionals researching specific medical conditions or treatment options. Content marketing through educational webinars, clinical case studies, and peer-reviewed publications helps establish thought leadership while supporting lead generation objectives.

Traditional channels including sales representatives, trade shows, and medical conferences remain important but should be integrated with digital touchpoints to create seamless customer experiences. Sales representatives should be equipped with digital tools that enable real-time access to customer interaction history and personalized content recommendations.

Future Outlook and Emerging Trends

The medical device marketing landscape continues evolving rapidly, driven by technological advancement, regulatory changes, and shifting healthcare professional preferences. Artificial intelligence and machine learning applications are becoming more sophisticated, enabling predictive analytics for customer behavior and automated content personalization at scale.

Regulatory agencies are adapting to digital marketing realities while maintaining patient safety priorities. The FDA’s guidance on digital health technologies and software as medical devices will likely influence marketing requirements for connected devices and digital therapeutics. Companies must stay current with evolving regulatory expectations while building flexible marketing systems that can adapt to changing requirements.

Healthcare professional preferences continue shifting toward digital-first interactions, with younger physicians demonstrating particularly strong preferences for online education and peer networking. Virtual reality and augmented reality technologies are emerging as powerful tools for product demonstrations and medical education, particularly for complex surgical devices and implantable technologies.

However, challenges persist that may limit digital marketing effectiveness. Regulatory compliance remains complex and resource-intensive, particularly for companies operating in multiple international markets. Healthcare professional skepticism about promotional content requires continued emphasis on clinical evidence and peer validation. Privacy regulations and data security requirements add complexity to customer data management and personalization efforts.

Key Takeaways

Medical device marketing success requires balancing regulatory compliance with innovative engagement strategies. Top-performing companies achieve 44% CAGR by implementing comprehensive digital marketing approaches while maintaining rigorous quality standards. The industry’s $381 billion economic impact and 519,000 direct jobs underscore the importance of effective marketing for both individual companies and broader economic health.

Digital marketing adoption has accelerated dramatically, with 90% of companies reporting improved success metrics and average budget allocations expected to reach 40%. However, success requires more than technology implementation—it demands organizational change management, integrated omnichannel approaches, and continuous optimization based on performance data.

The regulatory foundation remains critical, with FDA classification determining marketing pathways and promotional constraints. Companies must develop marketing strategies that align with regulatory requirements while creating compelling value propositions for healthcare professionals who increasingly expect clinical evidence and meaningful innovation.

Future success will depend on companies’ ability to adapt to evolving healthcare professional preferences, leverage emerging technologies like AI and VR, and maintain compliance with changing regulatory requirements. The performance gap between industry leaders and laggards suggests significant opportunities for companies willing to invest in comprehensive marketing transformation.

References

[1] U.S. Food and Drug Administration. “How to Study and Market Your Device.” October 12, 2023. https://www.fda.gov/medical-devices/device-advice-comprehensive-regulatory-assistance/how-study-and-market-your-device

[2] McKinsey & Company. “Value creation priorities shaping medtech.” October 16, 2024. https://www.mckinsey.com/industries/life-sciences/our-insights/value-creation-priorities-shaping-medtech

[3] AdvaMed. “Medical Device Industry Facts.” 2024. https://www.advamed.org/medical-device-industry-facts/

[4] AdvaMed. “Job Creation.” 2024. https://www.advamed.org/medical-device-industry-facts/job-creation/

[5] McKinsey & Company. “The rise of digital marketing in medtech.” September 24, 2021. https://www.mckinsey.com/industries/life-sciences/our-insights/the-rise-of-digital-marketing-in-medtech